The Buck is Greatly Under Pressure, the USD/CAD Free Fall is Accelerating

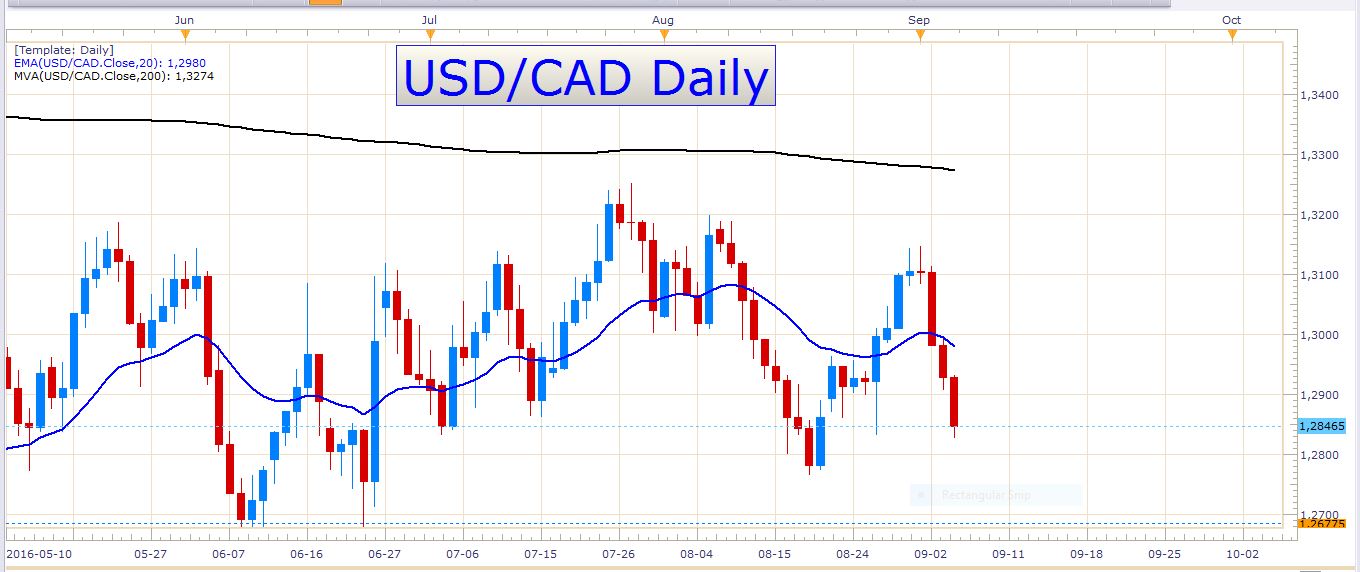

I love it when a plan comes together. In an earlier article, I wrote about two short trade setups on the USD/CAD. Unfortunately only the aggressive entry was triggered. Nevertheless, this trade is doing very well with the current US dollar weakness. Those of you who used this setup should be in profit by about 180 pips by now. The target is about 67 pips away, and if you have not neutralised your risk yet, now is a good time to bring your stop loss to breakeven. You can of course also move it past breakeven to lock in some gain. Just be careful not to trail it too close to the current price. Our target is well within reach, and we don’t want to get stopped out unnecessarily. Let’s look at a daily chart of the USD/CAD:

USD/CAD

USD/CAD Daily Chart

This is what we call impulsive selling. Look at how long these bearish candles are. For the last three trading days, the pair has just been plummeting. The combined loss over these three days is about 260 pips. Let’s look at an hourly chart:

USD/CAD Hourly Chart

As you might know by now, I love to enter the market at pullbacks to the 20 EMA on different timeframes. Here we see another perfect short entry on the 20 EMA. With this magnificent decline we saw in the last three days, short traders could virtually have entered anywhere and made money, however, it is always better to be prepared for an unexpected retracement. Price seldom moves in a straight line for very long, and therefore it is wise to be patient and wait for retracements or bounces to sell. Here the price declined really aggressively right after it bounced off the 20 EMA. Notice how you could have entered a really great trade with a small stop loss compared to the target. Seeing that the pair has been declining at a very fast pace for the last three days, I would not sell the first retracement that we get to the 20 EMA now. The reason for this is that perhaps we could see some profit taking soon, and the retracement might ascend well past the 20 EMA on an hourly chart. Perhaps the 20 EMA on a 4-hour chart may offer a better level to sell the pair at. Look at the following chart:

USD/CAD 4 Hour Chart

I have extended the 20 EMA on the chart just to give you a picture of how the 20 EMA could move as the market moves. Remember that we could get a much larger retracement than this, so make sure to analyse the technical and fundamental situation closely before entering a trade. We can be sure about one thing, and that is that the bearish market players are dominating this pair for now. The trend is your friend, and if you play this pair correctly, you might make some handsome profits soon. Tomorrow we have an interest rate decision out of Canada, so be careful of extreme volatility. If the Bank of Canada keeps their rates unchanged I reckon that the Canadian dollar will retain its current strength. Just remember that we also have Canadian Ivey PMI numbers released at the same time as the interest rate decision.

AUD/USD

I mentioned in yesterday’s article that I was concerned about short trades on this pair. I also recommended neutralising your risk (if possible) on any short trades because of the event risk we faced today, and will face tomorrow (2nd quarter GDP numbers out of Australia). The pair has climbed remarkably today, and the short side does not appear to be very attractive right now. The RBA kept their interest rate unchanged at 1.5%. This did not really move the exchange rate a lot. The big market mover was the US ISM Services PMI number which was released later in the day. Look at how the pair ripped today:

AUD/USD Daily Chart

Just look at how the pair shot through the 20 EMA! What a strong performance by the Aussie today!

USD/CHF

The short setup on this pair that I posted on the 29th of August (https://www.fxmarketleaders.com/forex-blog/tough-trading-in-fx-many-major-pairs-are-ranging) went really well, and the trade is currently in profit by more than 130 pips. If you’ve taken this trade, you might want to bring your stop loss to breakeven (or past breakeven), and congratulations on an excellent trade! Let’s look at a daily chart:

USD/CHF Daily Chart

Other important economic data scheduled for tomorrow

Besides the data points mentioned earlier, there are also some other events to keep an eye on tomorrow. Out of the UK, we have manufacturing production numbers at 08:30 GMT, plus inflation report hearings and a speech by BOE governor Mr Mark Carney at 13:15 GMT.

Best of luck with your trading!