The US Dollar is Rocketing Higher While the Pound is Trading Lower

What a day for the US dollar! The US dollar index printed its fourth consecutive bullish day today. The biggest loser among the majors has definitely been the British pound. The pound is still under pressure following the recent Brexit headlines, and as expected, the currency continued its decline today. The GBP/USD lost about 400 pips in the last six trading days. Let’s look at a few charts:

US Dollar Index Daily Chart

This index is a composite of the US dollar against four major currencies namely the Australian dollar, Japanese Yen, Euro, and the British pound. Notice how this index has broken through the 200-day moving average on Tuesday with ease. This is a very important moving average that is observed widely in the investment world. An instrument is normally considered to be in an uptrend when its price is above this moving average, and conversely in a downtrend when its price is trading below it.

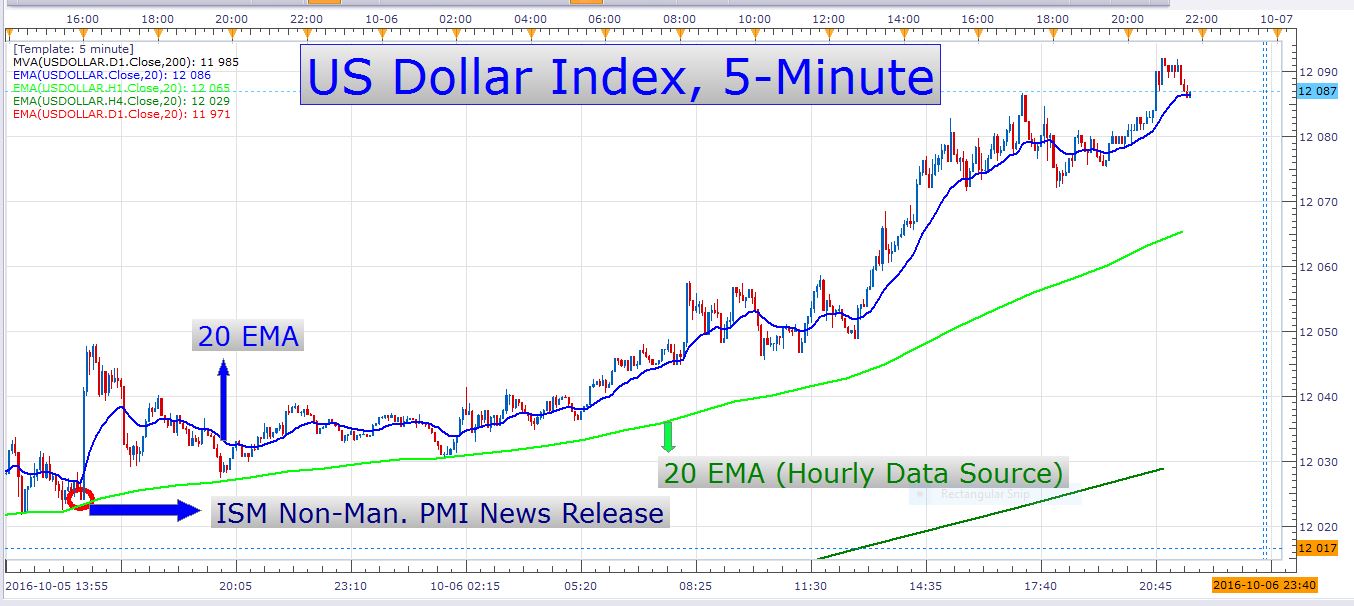

On Wednesday the US ADP Nonfarm Employment change number came out weaker than expected, but it didn’t really have an effect on the dollar. A little bit later the US ISM Non-Manufacturing numbers shattered expectations with a number of 57.1 versus an expected number of 53. The bulls quickly bid the dollar higher, and until now the price has not touched the opening level of the 5-minute candle that followed this news release. Look at the following charts:

US Dollar Index 5-Minute Chart

US Dollar Index 5-Minute Chart

Quite an impressive bull-run, isn’t it? I can’t wait for tomorrow’s NFP release. The ADP number (that was released on Wednesday) is considered to be a good predictor of the more important Nonfarm Payrolls release (which is scheduled for tomorrow). As I mentioned, the ADP number came in shy of expectations. The forecasted number was 166,000 while the actual reading was 154,000. Tomorrow’s forecasted NFP number is 175,000. What I’m going to keep an eye on tomorrow, is to see if we get a print that is slightly weaker than the forecasted number. Let’s say, a reading of somewhere between 145,000 to 165,000. This would probably cause the dollar to trade lower for the first five to fifteen minutes. If this happens, I will look for an opportunity to fade the initial weakness. Look at what happened in September when the released number (151,000) missed the forecasted number (180,000) by 29,000:

US Dollar Index 5-Minute Chart

This is just an example of how to fade the initial market reaction to a disappointing NFP release. This requires much skill, but it can be a very profitable way of trading this particular event risk. Although this example is on the US Dollar index, it is not where I prefer to use it. I like using it on actual currency pairs which involve the US dollar.

When using this strategy, it is important to wait for some form of confirmation that the buyers are stepping back into the market, like for instance this long wick that was formed on the entry candle in the chart above. I like the idea of using this news-fading strategy to play the dollar against the pound tomorrow. The pound is especially appealing because of the fundamental hurdles that lie ahead of it. It looks like market players are approaching NFP Friday with a long US dollar bias. I don’t think a moderately weak NFP report will turn the dollar bull’s head around. Of course, anything can happen, so be sure to use proper risk management and the correct position size if you’re going to trade this event. You don’t want to risk too much with this type of trading technique. Remember that we’re trading probabilities and that we might lose more trades than we win, but with a good risk to reward ratio, we’ll be making money even when this is the case.

There are many possible scenarios for tomorrow’s NFP release. One of them is the possibility of a much better than expected print. This would most probably cause a major US dollar rally. I am personally not fond of chasing after a fast moving market, but there certainly is money to be made with this type of trading if you know what you’re doing. The other option is to pre-position yourself for the event, but this can be very dangerous and is not suitable for inexperienced traders.

Besides the NFP release tomorrow at 12:30 GMT, there are one or two other important events to watch. The first one is the UK manufacturing production number which will be released at 08:30 GMT. The next one is released at the same time as the US NFP numbers – the Canadian employment change numbers. Then we have some more data out of Canada, namely the Ivey PMI number which will be released at 14:00 GMT. Remember that many times other data releases which are on the same day as the NFP report are largely ignored, or their effect on the market is often quite muted. I’m thinking of this especially in terms of the UK manufacturing number that precedes the NFP report tomorrow.

Hope you have a great trading day!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account