Low Volume and Profit Taking Could Further Pacify the Currency Market

The FX market has been really quiet so far this week. At the moment there is little to get excited about as forex traders. So what do we do when markets consolidate like this? Well, it depends on your trading style, of course. If you like day trading or scalping, this week might not be very suitable for your strategies and techniques, except if you’re a range trader who knows how to pan out pips in quiet markets. For long-term traders and swing traders, this week could offer opportunities to accumulate positions, or just to do some planning and technical analysis.

Of course, we can never rule out volatility in the FX market. Unforeseen events that shake the currency market occur from time to time and these events can happen at any time. Something else to factor in is the uncertainty that surrounds the whole OPEC oil supply deal. Some currency pairs are very sensitive to fluctuations in the oil price. The Canadian dollar is one of them. If OPEC members and other oil producing countries manage to agree on an oil supply freeze, the oil price would quickly rise and the Canadian dollar would benefit from the bid in oil.

Something else that could possibly be a moderate market mover, is the FOMC meeting minutes release which is scheduled for Wednesday at 19:00 GMT. I personally don’t expect a severe effect on the financial markets, but we should be prepared for volatility nevertheless. The FED is not likely to change their stance on monetary policy abruptly, and they do not like to shock the markets. Besides this, the holidays have a way to mute the effect of news releases because of a lack of market participation.

Other events which could play a role in FX market on Wednesday are the following:

German Manufacturing PMI at 08:30 GMT

US Core durable goods orders at 13:30 GMT

US New home sales at 15:00 GMT

US Crude oil inventories at 15:30 GMT

Let’s look at a few pairs:

AUD/USD

I really like the impulsive selling that has driven this pair lower in the last couple of days. Monday and Tuesday’s bullish candles are corrective in nature, and after this correction is over, the AUD/USD will probably decline further. It is possible that this pullback which is forming could continue to push higher until the weekend, or even into next week. This retracement could offer great opportunities to enter short positions on this pair. Traders who would like to short this pair might want to wait for some kind of confirmation before entering the market. Perhaps some impulsive selling on a lower timeframe, or the formation of a daily pinbar candle. The ideal scenario would be if the retracement reached a zone where former support is situated. This previous support zone could turn into a new resistance area. Look at the following chart:

You might have noticed that a short entry near this blue circle would enable you to place a relatively tight stop loss just above the 200-day moving average (the black moving average). It could be helpful to have this moving average between the market price and your stop loss, as the 200-day moving average often acts as a resistance level in a downtrend. From a technical standpoint, the AUD/USD is definitely in a downtrend and therefore we should only be looking for opportunities to sell this pair.

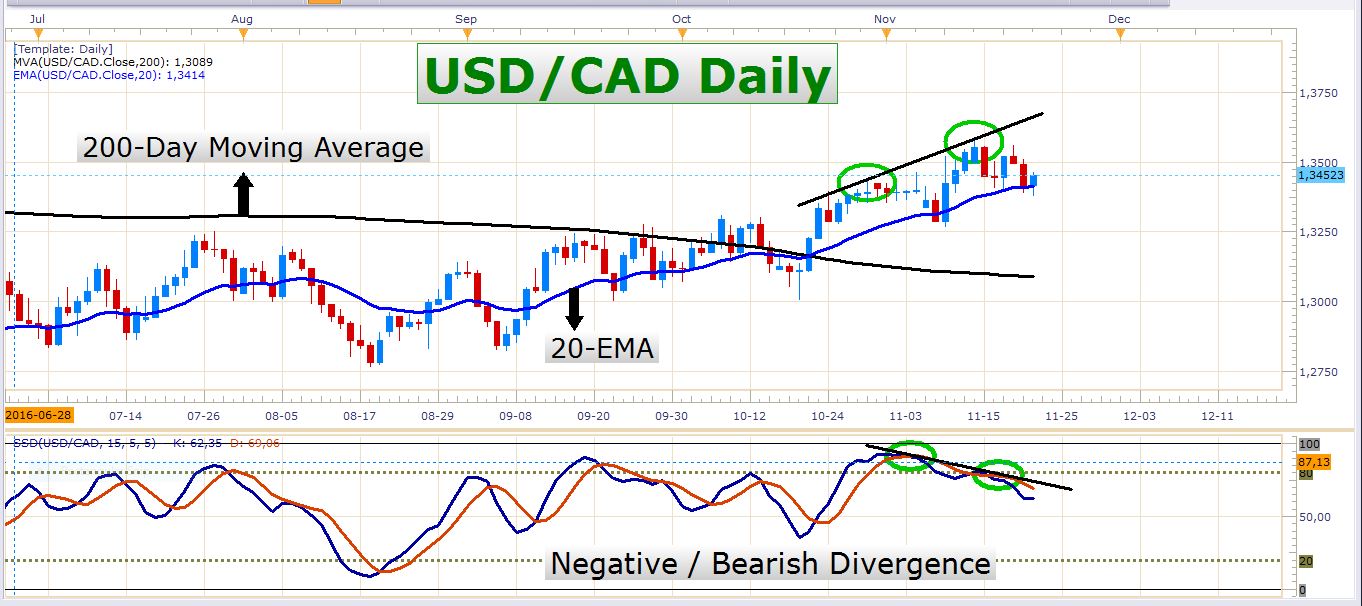

USD/CAD

This pair is anxiously awaiting OPEC news. On Tuesday this pair chopped around a bit, but still managed to print a bullish candle. The exchange rate remains supported by the 20-day exponential moving average, and the technicals suggest that the pair could advance further in the days and weeks ahead. If OPEC and the other parties involved in the oil talks manage to strike a notable production cut deal, the USD/CAD technicals might have to give way to the fundamentals, even if it’s just a temporary decline in the exchange rate. Market players don’t trust OPEC, and even if an agreement is reached, it doesn’t guarantee that all involved parties will abide by it. If you’re trading Canadian dollar pairs or planning on trading them, be careful and minimize your risk. There could be an explosion of volatility in oil and the Canadian dollar in the next week or two.

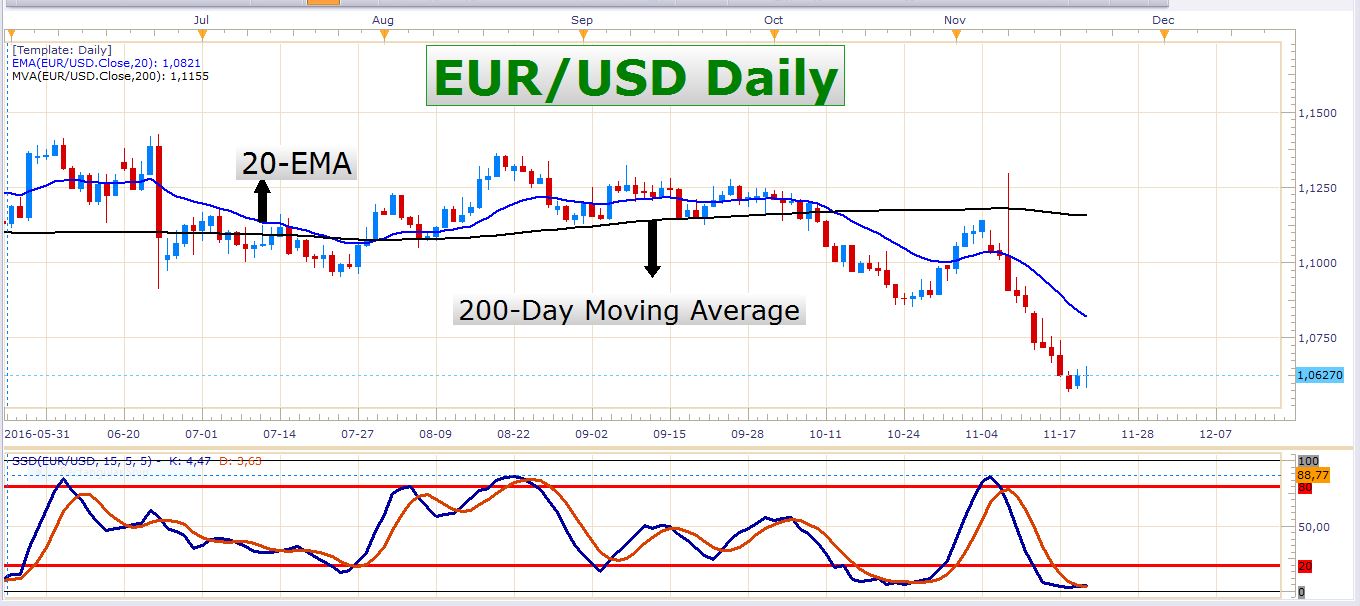

EUR/USD

This pair looks like it might correct higher over the next few days. Exhaustion is certainly playing a role here. The preceding decline was extremely aggressive and covered a lot of distance in a very short time. This often leads to a situation where the price pops up just like a basketball which is released under water quickly pops out of the water. I reckon we could get some splendid opportunities to sell this pair again but now doesn’t seem like the best time. A decent pullback would offer an opportunity to enter the market with less risk and a greater potential for reward.

Something else to take note of is that the slow stochastics indicator is in oversold territory and that the K and D lines are busy crossing over. This hints at a possible correction taking place soon. Look at the following chart:

Just a reminder, Wednesday is Labor Thanksgiving Day in Japan, and Thursday is Thanksgiving Day in the United States.

Have a splendid trading day!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account