Causes for Pullback in WTI Crude Oil

Morning, fellow traders. Hope you are doing well and enjoying our insights. Here we have another one for you!!!

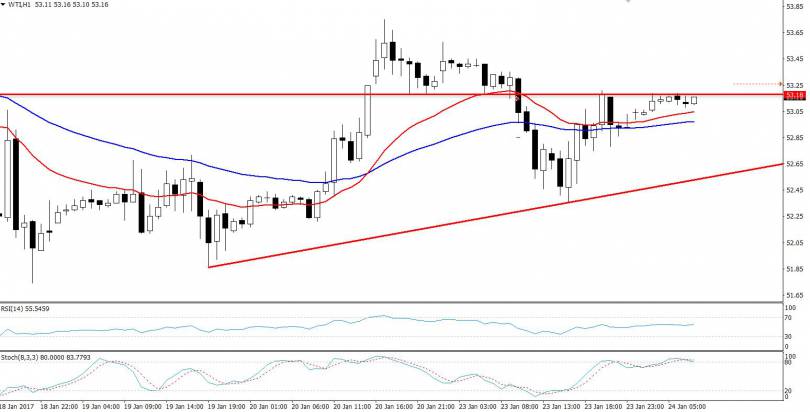

Let’s recall the yesterdays analysis, where the crude oil tested our recommended level of $52.57 and helped us secure more than 55 pips. Today, crude oil is trading slightly higher around $53.14 in the early trading sessions. The bearish trend in the black gold was short lived and it reversed right after placing a low of $52.35.

Besides this, the weaker U.S Dollar helped to underpin the crude oil in early trading sessions on Tuesday. Moreover, oil traders are also focusing on the data released on Friday that revealed the U.S. drillers added 29 rigs, the highest in around four years by the end of the previous week, delivering the total count up to 551.

Focusing on the technical’s, crude oil has retraced around 61.8% and now it's likely to have a strong resistance at $53.20 (support become resistance level). I would recommend to take selling trades only below $53.20, aiming $52.90 and $52.68, while the buying positions are recommended above $53.20 with a target of $53.40.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account