Rising Tension Between U.S and Iran Pushed Oil Prices Higher

Oil prices soared on Thursday after a significant increase in U.S. crude oil inventories, while production data revealed that OPEC and Non-OPEC countries are respecting the agreement in order to curb oil production. This helped oil prices to surge above $53.50 by Wednesday.

Following the market sentiments, Brents crude Wednesday closing was above $56.40, whereas Tuesday closing was under $55.60.

U.S. crude oil inventories ascended last week by an unexpected 6.5 million barrels to 494.76 million barrels. Inventories in the United States, the world's biggest oil consumer, have been near record highs for much of the last year and the domestic U.S. shale oil companies' production is rising, but couldn’t have any significantly impact till now.

Meanwhile, aggressive language from U.S. President Donald Trump's administration on Iran and a refugee deal with Australia also put the focus back on the geopolitical risks.

President Trump had frequently criticized the Iran nuclear deal, calling the agreement weak and ineffective. Tension between the United States and Tehran is also rising after Iran tested a ballistic missile, raising the possibility of future sanctions that could curb Iranian oil supply.

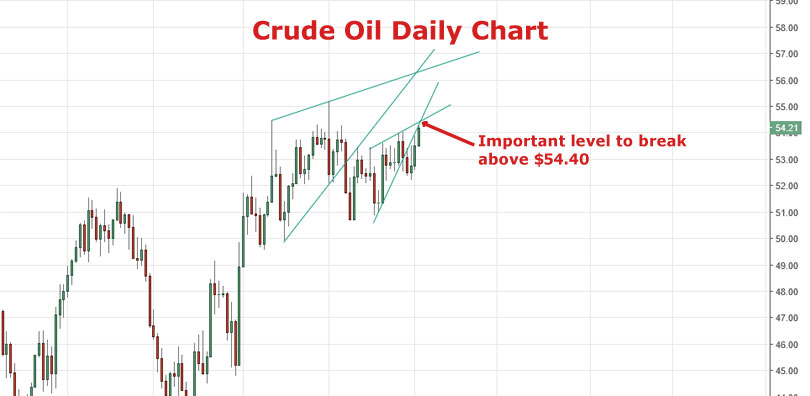

Let’s have a look at the Crude Oil daily chart given below:

This is the Crude Oil daily chart.

U.S. President Donald Trump's administrations jawboning helped the oil prices to surge. The market is still looking towards the upside range limits, with breakage expected. If Thursdays closing of crude oil remains above $54.50, I must enter long-term buy till $56.20. However, a breakage of $54.40 seems hard today.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account