Gold Speculators Trimmed Exposure – FOMC Ahead!

The gold traders are stretching upward before the US trading session today. The United States is about to release very important economic figures which are known to cause dramatic changes in the gold prices. Refer to our earlier report, Forex Signals Brief for June 14th – FED Policy Decision Simplified, Get Ready To Trade! for a more detailed account of what to expect.

For now, the gold is consolidating in a very narrow range of $1266 -$1270 due to thin trading volume as most investors are waiting to trade the market until after the Federal Reserve's policy decision.

How Is FOMC Likely To Impact The Gold?

Hawkish FOMC – The gold prices are likely to "dip" in the case of a contractionary monetary policy. This would include, interest rate hikes, a shift in Dot Plot (more than 1 rate hike in 2017) and optimistic economic outlook.

Dovish FOMC – Alternatively, if the Fed leaves the interest rates unchanged at 1%, we are likely to see some serious gains in the gold prices.

In my opinion, investors have already traded the rumors (interest rate hike sentiment) and now are waiting for the actual fact.

Forex Trading Signal – Idea

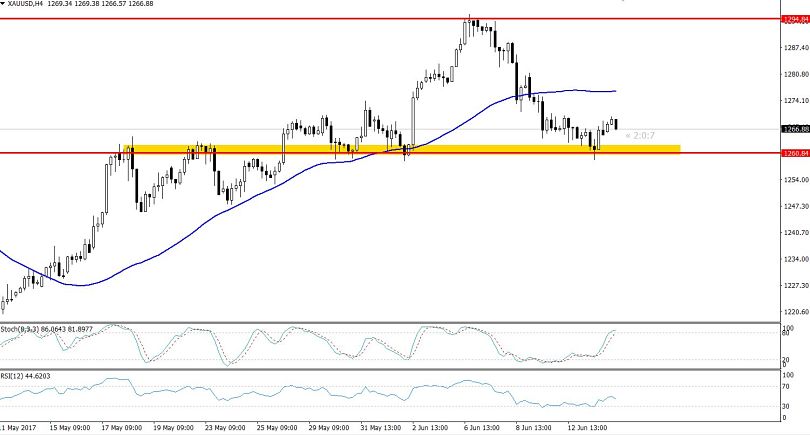

I'm keeping my eyes on the game changer trading level of $1259/60. I'm looking to add a sell below until $1254 & $1248. While on the upper side, the target is $1274 and $1279.

Gold – 4 Hours Chart – Triple Bottom Pattern

Gold – 4 Hours Chart – Triple Bottom Pattern

Technical Outlook – Intraday

Technically, on the 4 – hour chart, the $1259/60 is under the spotlight due to the following reasons:

- Gold has a formed a triple bottom pattern which is extending a firm support at $1259/60.

- Gold has completed 38.2% Fibonacci retracement at $1259/60.

- The 50- period's exponential moving average is supporting the metal at $1259.48

- Lastly, the test bar above $1259 confirms investors' intentions.