Boosted Haven Appeal – Gold Shines Like Before

Gold gains for the 3rd consecutive trading day, trading at $1253 due to boosted haven appeal and unfavorable economic events from the United States. Additionally, the gold is also bullish for the technical reasons, we elaborated on in our previous update.

Earlier this week, after having support above the $1,240 level, the precious metal gold prices climbed towards $1,255 per ounce. One of the reasons for this was the boosted demand for haven assets. It started when the Chinese bank regulator caught some major Chinese private firms borrowing and using the money to buy assets overseas.

The country's bank regulator asked the large lenders to check and report the credit risk profiles of various major companies that had borrowed massively in the dollar in order to buy assets abroad. Keep in mind, China has good business relations with India and both of these are major gold importers.

Forex Trading Signal – Idea

We have two trade ideas because the gold prices are in between trading levels.

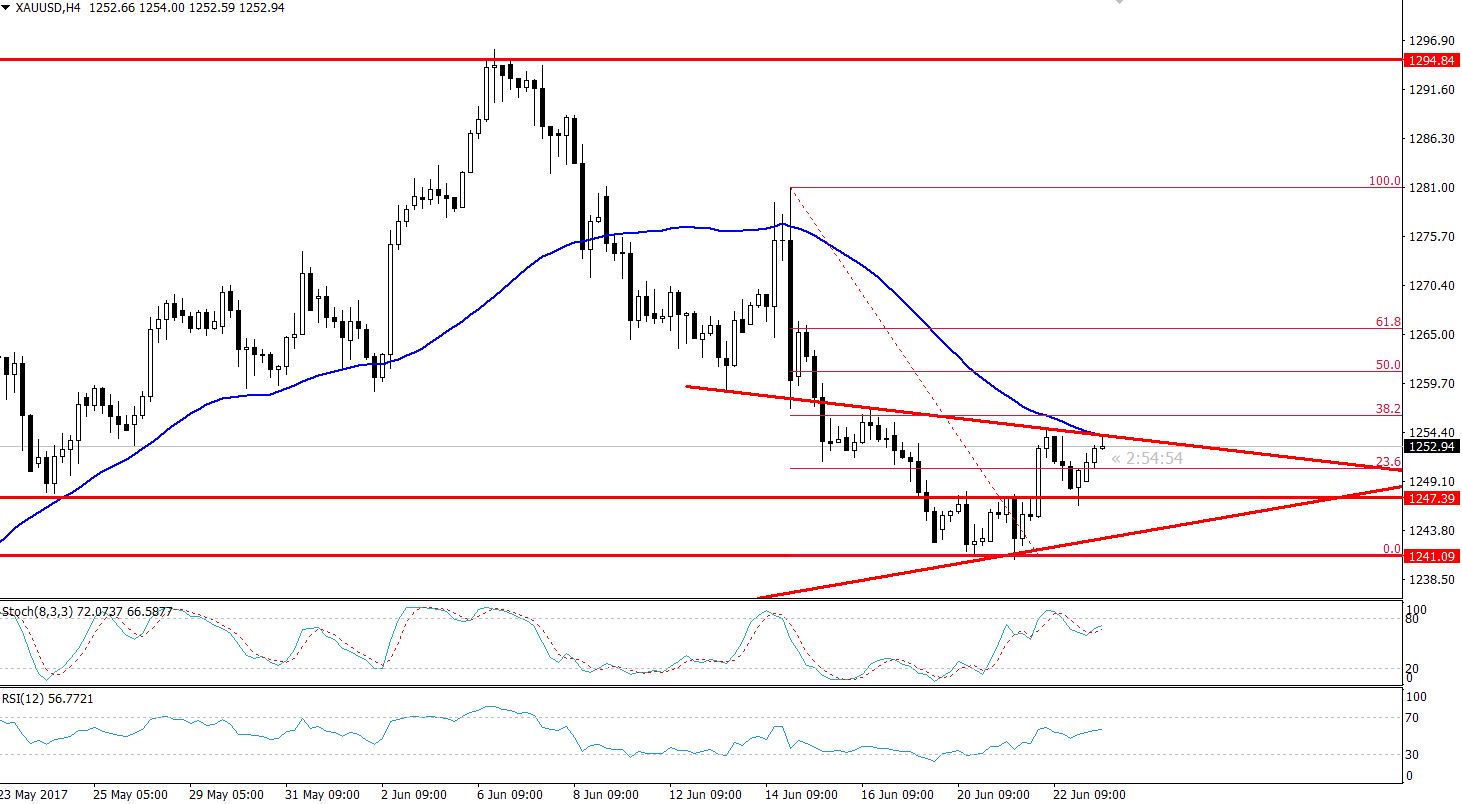

- Sell below $1254 with a minor stop loss of $1257 and take profit of $1250.

- Buy above $1247 with a stop loss below $1245 and take profit of $1252.

Gold – 4-Hour Chart

Key Technical Points:

– The oversold gold is edging higher to 38.2% Fibonacci retracement level of $1256.

– The market has formed a 3 White Soldiers pattern on the daily chart, demonstrating a continuation of solid bullish momentum.

– On the hourly chart, 50 periods EMA is extending a strong resistance at $1255. The upside crossover is likely to likely to add further room for buying until $1261 & $1265.