Forex Signals Brief July 24th – 30th, FED Monetary Policy Meeting In Focus

Welcome back, traders. Here's to hoping you had a refreshing weekend and are ready for the exciting trade opportunities ahead. We are expecting some top-tier economic events this week, which have the potential to change the structure of the technical outlook of the market. I would especially keep an eye out for the fundamental events from the United States. Keep reading to find out more about what we have to look forward to this week!

Top Events On This Week's Docket

FED Monetary Policy

Federal Reserve Monetary Policy decision will be in focus on Wednesday at 18:00 (GMT) and it could influence the global markets. This includes the Fed Fund Rate which is unlikely to change this month, though next month's odds are a bit higher. Therefore, we can expect the US dollar to remain under pressure before the release of the fundamentals.

Additionally, it is worth watching the FOMC Statement because it contains the outcome of the Fed officials votes on interest rates and other policy measures, along with the review of the economic conditions that influenced their vote. Most importantly, it presents the economic outlook and offers clues about rate hike intentions. So, it may have a significant impact.

AUD – On Wednesday, at 1:30 (GMT), the Australian Bureau of Statistics will release the CPI q/q which is expected to remain lower (0.4%) than the previous one 0.5%. On the same day, at 3:05 (GMT), RBA Gov Lowe is due to deliver a speech titled "The Labor Market and Monetary Policy" at the Anika Foundation Luncheon, in Sydney. High volatility is expected due to audience questions.

Four GDP's (Gross Domestic Product) This Week

Aside from FED policy decision, we need to watch gross domestic product from the global economies. It's a quarterly release and often has long term impacts on the market. Policy makers also consider this GDP figure when voting for the rates.

GBP – Prelim GDP q/q is scheduled to be released on Wednesday at 8:30 (GMT) with a forecast of 0.3%, higher than the previous 0.2% figure. This places more pressure on the BOE to hike the rate sooner.

U.S – Advance GDP q/q is due to be released on Friday at 12:30 (GMT) with a forecast of 2.5%, higher than the previous figure 1.4%.

CAD – GDP m/m is expected to be released on Friday at 12:30 (GMT) with a neutral forecast of 0.2%.

EUR – Spanish Flash GDP q/q is also due on Friday at 7:00 (GMT), but it may have less of an impact on the market compared to the GDP's from the UK, Canada, and the United States.

EUR/USD – Is It A Long Term Reversal?

Over the previous week, the greenback grappled around a 13-month low against peer currencies as US investors s hopes for Trump's stimulus and tax reform programs were squashed. Whereas, the single currency Euro has been on bullish footing after European Central Bank President Mario Draghi's speeches sounded hawkish over recent weeks.

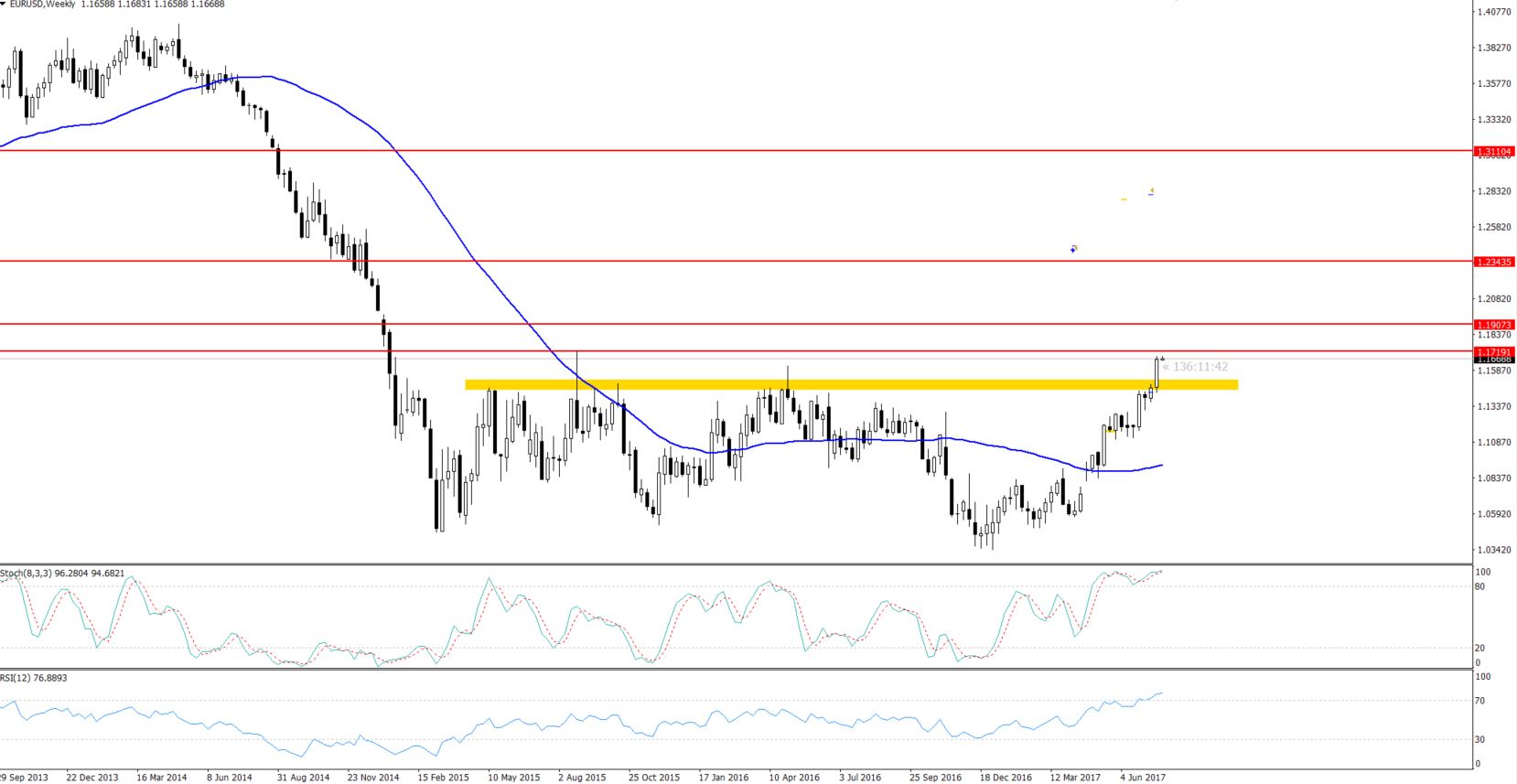

As I mentioned in my previous weekly update, the EUR/USD has a chance to determine the long-term trend. Zooming out to the weekly chart, we can clearly see the major has already broken above $1.14750 to target $1.1710.

EUR/USD – Weekly Chart – Bullish Breakout

EUR/USD – Weekly Chart – Bullish Breakout

This week, we may see another round of bulls dragging the EUR/USD towards $1.18450 due to the dovish FOMC. Let's take a look at the weekly trading levels.

For tips on how to make more profit when trading, take a look at our Fx Leaders support and resistance trading strategy article.

EUR/USD – Hourly Chart – Horizontal Resistance

EUR/USD – Hourly Chart – Horizontal Resistance

EUR/USD – Key Trading Levels

Support Resistance

1.1593 1.1752

1.1503 1.1842

1.1344 1.2001

EUR/USD – Trade Idea

Since the market has already moved higher to $1.1669, we can't enter a buy position here. We need to wait for the market to retrace back a bit before we take a buy entry. Consequently, our trade idea is to have a sell position below $1.1720 with a minor stop loss above $1.1735 and a take profit at $1.1560. Make sure to keep a close eye on US economic events this week as they could have a huge influence on this trade.

To learn more about trading EUR/USD, feel free to read our FX Leaders article on how to trade the EUR/USD signals.

Good luck and get ready for the exciting forex trading signals ahead!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

EUR/USD – Weekly Chart – Bullish Breakout

EUR/USD – Weekly Chart – Bullish Breakout