Gold! Daily And Weekly Technical Outlook

July has been a great month for gold futures. A weakening dollar and political uncertainty surrounding the Trump administration have brought the gold bugs out of retirement. But, valuations are nowhere near the heyday of the 2008-11 global debt crunch. Are we headed back to $1800-$2000 gold?

In short, no. As long as U.S. equities are smashing all-time highs, then absolutely not. However, gold is the global standard for wealth. If anything is bothering investors, then gold will probably be the answer.

Weekly Technicals

There is no denying that gold is showing signs of life. Robust participation has been the daily rule driven by heavy volumes. That is very good for traders.

Weekly Gold Futures

For the first time in July, gold is trading above the 13-week simple moving average. In my view, this area is going to be the make-or-break point for the next month. We are likely to see consolidation for the immediate future, ending in exhaustion or continuation.

The next two weeks may provide a long-term turning point for the market. A double-top formation is present at April/June's high of 1298.7 and 1298.8. This is a key level to be respected.

Daily Technicals

Yesterday’s FED release gave gold a positive kick. With a relaxed monetary policy being championed, gold futures closed the day on a bullish note.

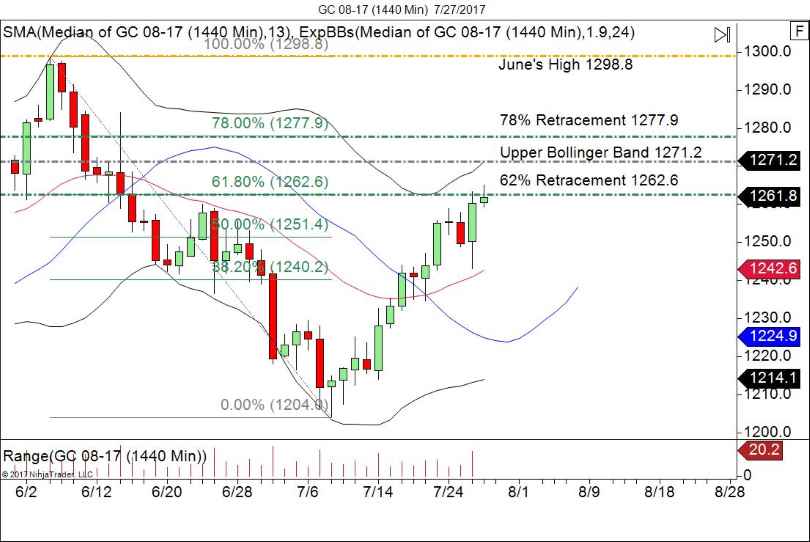

Gold Futures Daily Chart

Currently, gold is stumbling a bit, down on the day. No sustained buying over last session’s high has given way to midday selling.

Before gold can test the weekly double-top, there is some topside resistance to deal with:

-

61.8% retracement of June’s high and July’s low (near this level right now)

-

Upper Bollinger Band at 1271.2 (this number will change as we move forward)

-

78% retracement of June’s high and July’s low at 1277.9

Do I Trade It?

Absolutely. The strong participation will continue and provide many opportunities. Tomorrow is the release of the U.S. GDP figures, which is going to bring even more players to the table.

If you want to get involved in the gold market, check out some of the trading signals and ideas here on fxleaders.com. You miss 100% of the shots you do not take. This is a strong market, worth your best shot.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account