GOLD On Fire – What’s Going On In The Market?

I have been watching Gold for a bit now and it seems like I missed a decent buying opportunity overnight. Don't be sad, there is always som

I have been watching Gold for a bit now and it seems like I missed a decent buying opportunity overnight. Don't be sad, there is always something for us in the market. Check out our Gold trading plan to conclude the week with a profitable trade.

Why Buy Gold?

There is a strong negative correlation between the U.S. dollar and gold. Most of the bullish trend in Gold are caused by severe weakness in the Buck, here are a few reasons for this.

Unemployment Claims – The U.S. Initial jobless claims rose substantially to 298K for last weeks 236K level. It definitely puts some pressure on the Federal Reserve to hold the upcoming rate hikes. Consequently, putting Gold prices on fire.

Fed President William Dudley – The dovish remarks from Dudley added fuel to the fire, causing gold to break above the solid resistance levels of $1347. According to Dudley, a shortfall in prices is surprising however he still thinks the growth in Inflation is around the corner. Check out FX Leaders News Trading Strategy to gain more knowledge about fundamentals.

Technical Outlook

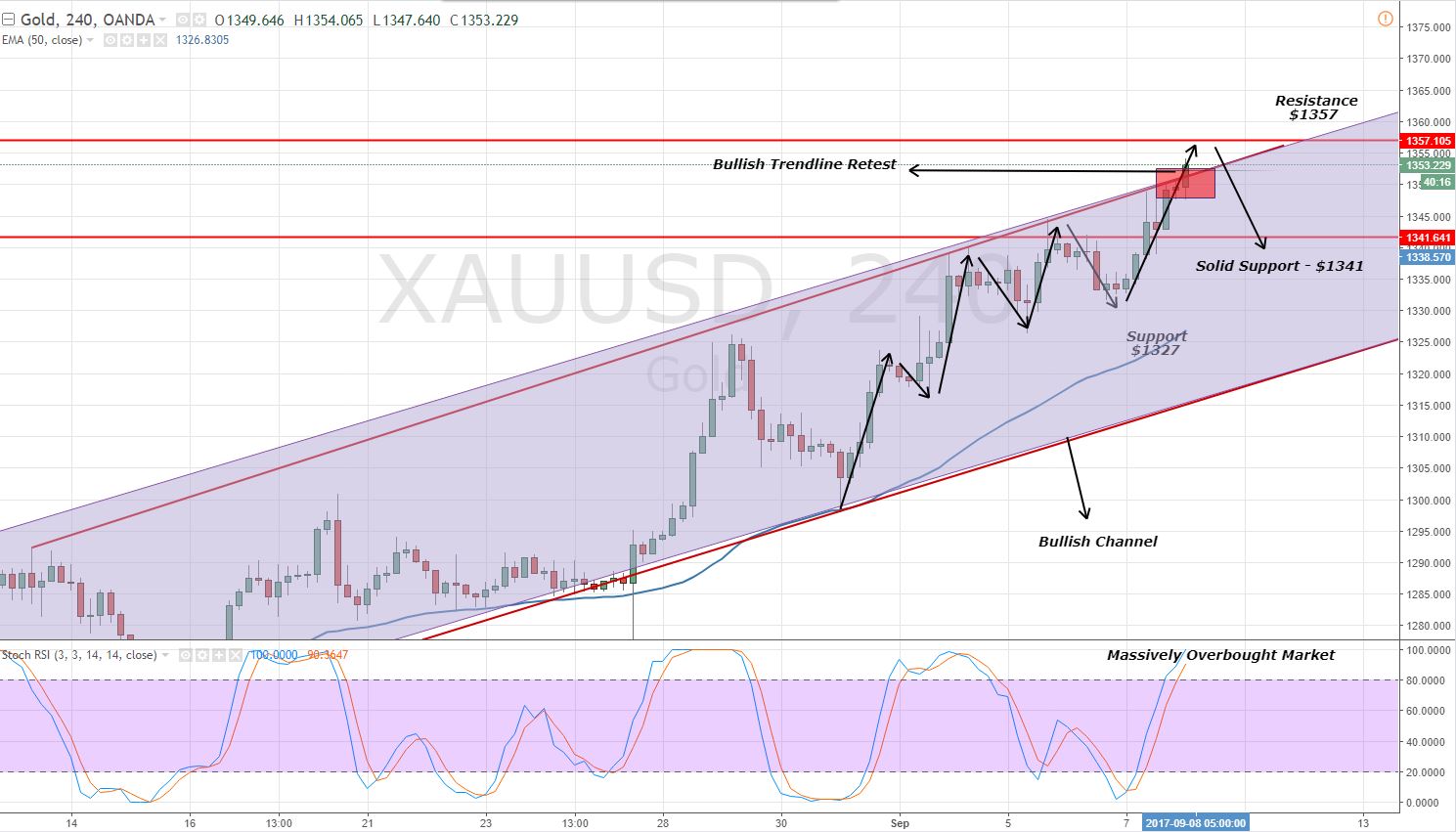

Remember the bullish channel on 4-hour chart, the Gold is testing the bullish trend line at $1353 and it's peaking out of it now. Probably, we can see a breakout in Gold but it all depends upon Friday's close.

Gold – 4 Hour Chart – Bullish Channel

Gold – 4 Hour Chart – Bullish Channel

For now, the major resistance is $1357/60 and I can't think of Gold crossing these levels today, until and unless there is a solid fundamental force behind it. The poor 50- EMA is left far behind at $1326, signaling that there is room for selling. Lastly, the Stochastic is overbought at 100 supporting the bearish bias for the Gold today.

Gold – Trading Plan

The yellow metal is between the major levels of $1342 and $1357, therefore I prefer to wait for the market to test $1357-59 to enter my sell position with a stop loss above $1362 and take profit at $1345. As always, remember not to risk more than 1-2% of your account and follow stick Money Management Strategy. Good luck fellows and have an awesome weekend!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Gold – 4 Hour Chart – Bullish Channel

Gold – 4 Hour Chart – Bullish Channel