Sideways Nikkei – Quick Buying Trade!

The market is a bit boring today due to lack of volatility and volume. It could be because of the upcoming Board of England's policy meetin

•

Last updated: Thursday, September 14, 2017

The market is a bit boring today due to lack of volatility and volume. It could be because of the upcoming Board of England's policy meeting, and the U.S. inflation figures which are being released today. However, we are always striving to come up with something profitable to trade. Check out our forex trading signal on Nikkei.

Nikkei – Quick Trade Setup

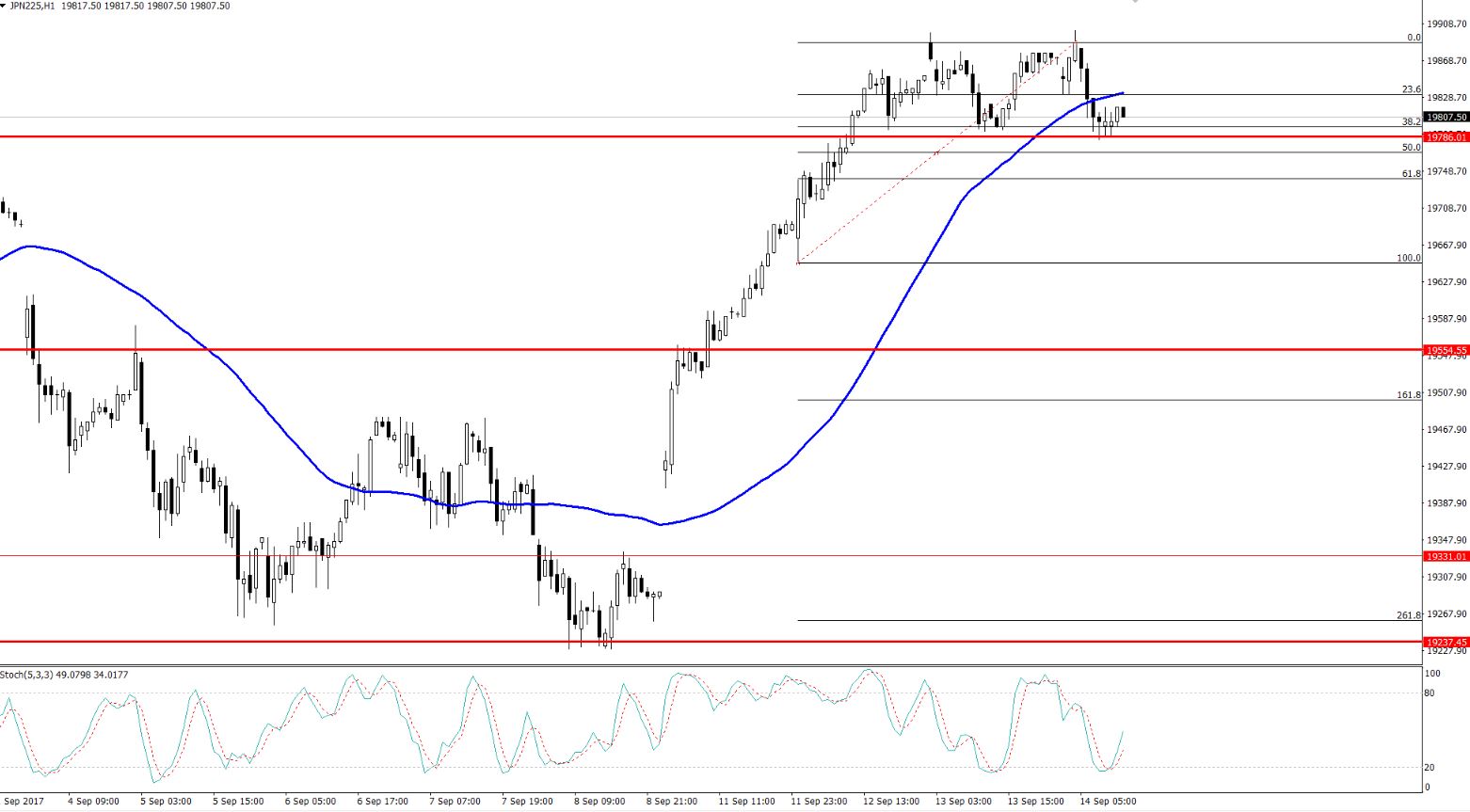

I was seeing the hourly time frame of Nikkei when a trade setup caught my attention.

Nikkei – Hourly Time Frame – Double Bottom Support

Nikkei – Hourly Time Frame – Double Bottom Support

- Though the Nikkei is overbought, it has competed for the 38.2% retracement at $19,785 in the hourly timeframe.

- We can see two consecutive spinning tops above the support level which signifies the neutral intention of investors. When it's followed by the bearish trend, it means the sellers and buyers are now at the breakeven level, so the potential of reversal seems imminent.

- The 50- periods moving average resistance is at $19,835, and crossover can lead the Nikkei higher. We also have a double bottom support at $19,775.

Nikkei – Trading Idea

Therefore, I decided to take a buying position above $19,785 with a small stop loss of $19,760 in order to target $19,835. Stay tuned as we may share more forex trading signals during the U.S. sessions.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.