Morning Preview: FOMC the Key for Traders this Week

Welcome to another big week in forex markets Lads!

It was another wild ride in forex markets last week, as we were again faced with hurricanes in the US and more drama from North Korea. Safe havens continued the whipsaw that they are now getting so accustomed to, while it was the GBP which soared to new heights.

Over the weekend the tension surrounding North Korea and what exactly Kim Jong-un might potentially do seemed to fade as there was no sign of another missile test. The last one which happened on Friday seemed to get largely brushed aside, as simply more of the same, as the safe havens reacted early but retraced.

This week is highlighted by another meeting of central banks and it’s the biggest show in town with Janet Yellen and the FOMC releasing their interest rate decision. While there is likely to be no change in official rates, the USD has the potential to be a little quiet in early trade, as markets ponder what the Fed has in store.

Top Economic Events this Week

Monday

EUR – Inflation

GBP – Mark Carney Speaking

Tuesday

AUD – RBA Minutes

EUR – German ZEW Index

Wednesday

JPY – Trade Balance

EUR – German PPI

GBP – Retail Sales

USD – Existing Home Sales

USD – FOMC Interest Rate Decision

Thursday

USD – Jobless Claims

EUR – Consumer Confidence

Friday

EUR – PMIs

CAD – CPI

USD – PMI

Top Trade to Watch

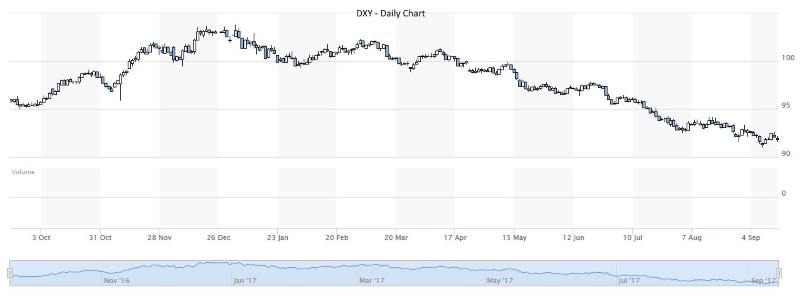

DXY – Daily Chart

All the focus is, without doubt, going to fall back onto Janet Yellen and what she intends to do with interest rates going forward. A stronger than expected CPI out of the US has the potential to sway opinion, however, it’s more than likely that we will see no change in official rates. Watch out for the press conference, where we will get more insight into the opinion of the Fed Chairman and what her timeline of events may well be.

The trend for the USD has been down since the start of 2017. Any potential hike in rates might give us the impotence for a rally, but unless there is some clear suggestion from Yellen, the trend to the downside might well continue.

It should be another great week for trading forex markets, so stay tuned for all our analysis as we have got you covered. Good trading guys!