Nikkei In Overbought Zone – Sellers Looming at Top!

Good afternoon, traders. The Asian session didn't give us a good start as our forex trading signal on Crude Oil hit by -15 Pips stop loss.

Good afternoon, traders. The Asian session didn't give us a good start as our forex trading signal on Crude Oil hit by -15 Pips stop loss. But, we concluded the session well with +60 pips take profit on the trade as suggested in GBPJPY Hit +40 Pips Profit – Get Ready for the Next Trade. Let’s take a look at Nikkei trading signal.

Nikkei – Quick Trade Setup

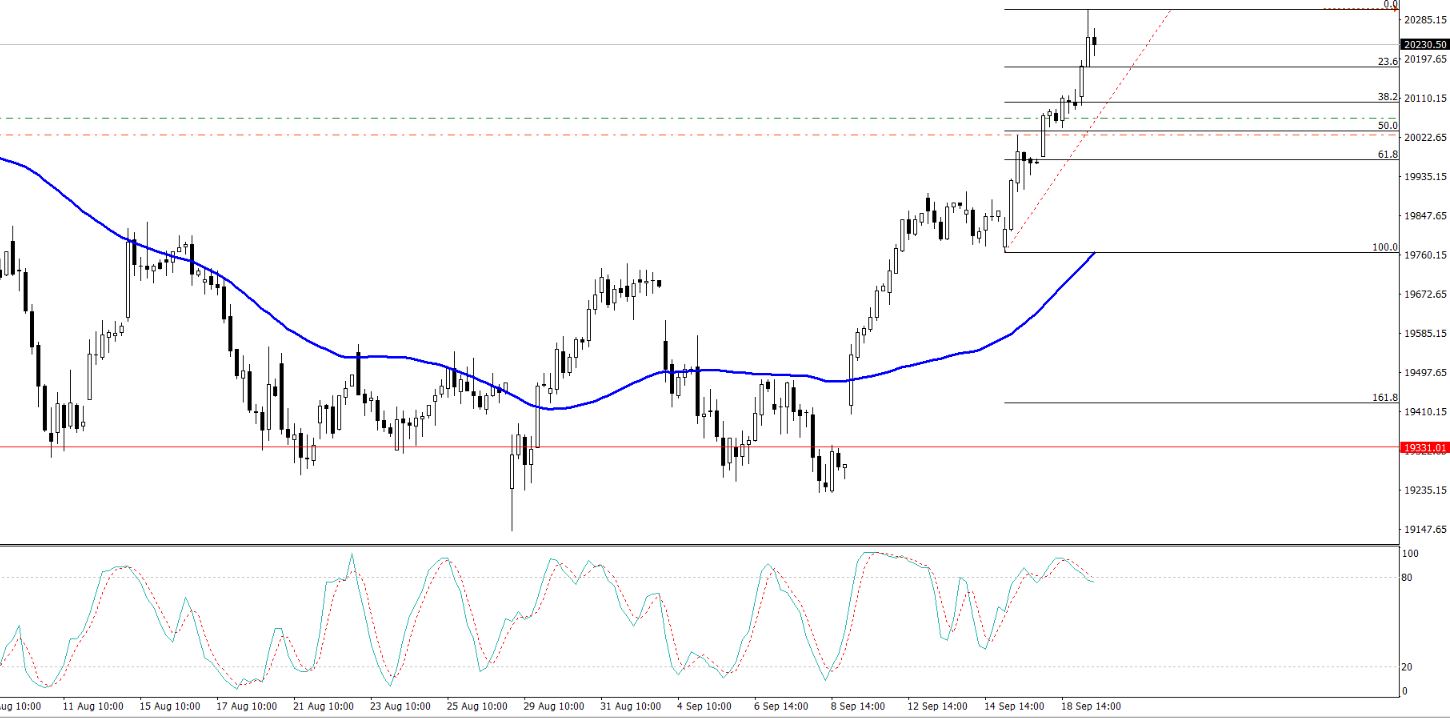

By having a quick look at the 4- hour chart if Nikkei, we can see the Japanese Index has soared dramatically to place a high of $20306, and that's the area where we can see a triple top pattern on the daily chart. It means, we can try a sell position below this to take quick profits.

Nikkei – 4 Hours Chart – Fibonacci Retracement

Nikkei – 4 Hours Chart – Fibonacci Retracement

In addition, the Nikkei is overbought, it needs to complete the 38.2% retracement at $20,098 in the 4-hour timeframe.

Nikkei – Trading Idea

Considering this, we just opened a forex trading signal to enter a sell position below $20,275 with a stop loss above $20,350 and take profit at $20,100. Good luck and keep following for more profitable trades.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Nikkei – 4 Hours Chart – Fibonacci Retracement

Nikkei – 4 Hours Chart – Fibonacci Retracement