U.S. Cash Open Brief: Pre-Session Metrics

Fridays can be tricky days to trade the forex and futures markets. Institutional participants are often looking to balance their ledgers go

Fridays can be tricky days to trade the forex and futures markets. Institutional participants are often looking to balance their ledgers going into the weekend and retail traders are interested in one last winning trade. Typically, we see bold activity on the U.S. session open and towards the close.

Personally, I like to treat the early Friday session just like any other day. As the day moves on, my P&L for the week beings to dictate my trading activity.

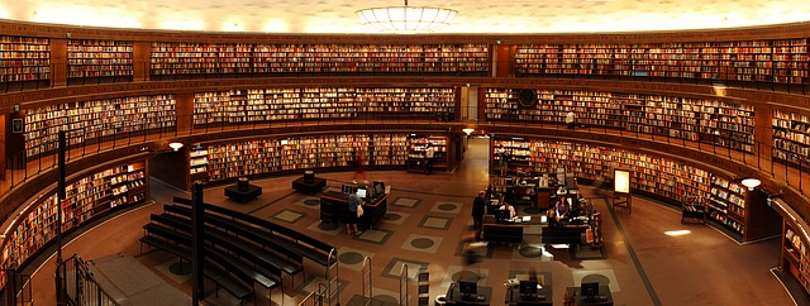

The Halls Of Academia Sure Make Their Presence Felt In The Markets!

The Halls Of Academia Sure Make Their Presence Felt In The Markets!

We have a few economic metrics up for study this morning, so let’s hit the books!

The Hard Data

It is consumption day facing the USD, with the U.S. Bureau of Economic Analysis releasing their views on consumer spending.

Event Previous Projected Actual

Core Personal Consumption (MoM, August) 0.1% 0.2% 0.1%

Core Personal Consumption (YoY, August) 1.4% 1.4% 1.3%

Personal Consumption (MoM, August) 0.1% 0.3% 0.2%

Personal Consumption (YoY, August) 1.4% 1.5% 1.4%

Personal Income (MoM, August) 0.3% 0.2% 0.2%

Personal Spending (August) 0.3% 0.1% 0.1%

There are no real surprises in this batch of numbers. However, the tone is negative towards the USD, as the consumption metrics all came in under expectations.

Personal Income for August is interesting because it runs counter-intuitive to our real estate numbers from earlier in the week. Mortgage Applications were up for August, yet personal income is down. That item is a bit curious and worth watching in the future.

Overview: So, what is the point of studying these numbers? As traders aren’t we primarily concerned with price action?

In my view, it is not where the numbers fall, but how accurate the estimates are. If analysts are spot on with their projections, then the market is likely to remain stable in the near-term. Also, there will be less of an impact upon market sentiment during future releases.

It is when there are huge surprises in the data that we have to reevaluate our entire fundamental approach!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

The Halls Of Academia Sure Make Their Presence Felt In The Markets!

The Halls Of Academia Sure Make Their Presence Felt In The Markets!