⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

It's been quite a nice experience trading cross-currency pairs, especially, the one with Japanese Yen. This week, the volatility has remained quite low for a simple reason. Yup, I'm talking about North Korea and the United States cold war.

Key Technical Points:

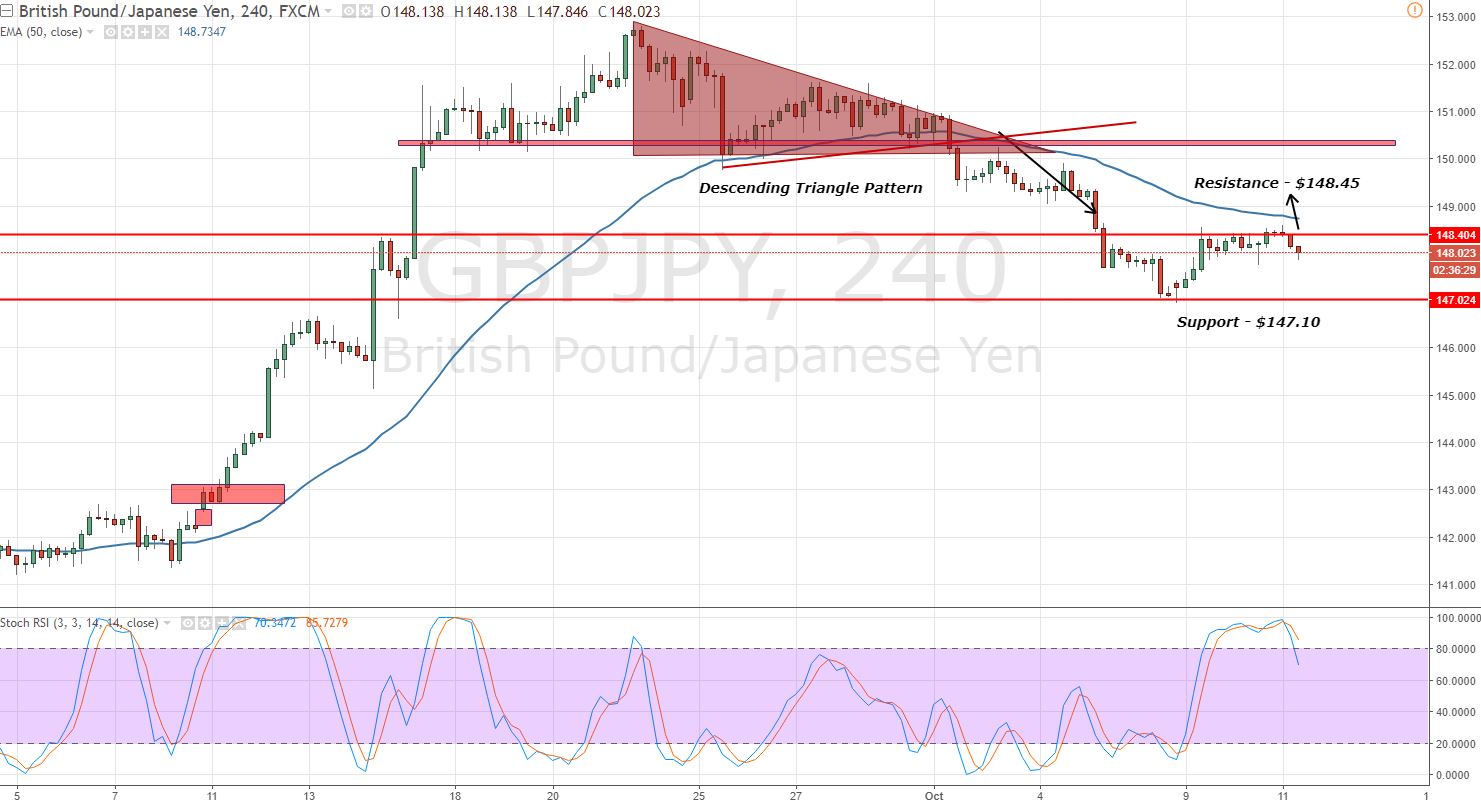

- The GBPJPY has broken below the ascending triangle pattern and since then, the pair is trading bearish.

- On the 4- hour timeframe, the pair has entered the oversold region. Look at the Stochastics and RSI, both of them are holding above 80.

GBPJPY – 4- Hour Chart – Sideways Range

GBPJPY – 4- Hour Chart – Sideways Range

- The 50- periods EMA is resisting the pair at $148.75. GBPJPY needs to show us a crossover before turning to the bullish trend.

- Lastly, the pair is stuck into the narrow range of $147 – $148.45. We can't say much which side the pair is going to breakout. All we can do is to wait for the breakout before placing any trade. Else, the trade will be a risk.

GBPJPY – Trading Idea

Today, $148.250 is an important level for GBPJPY. It will be nice to stay in sell below this level with a target of $147.65. Good luck!

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments

GBPJPY – 4- Hour Chart – Sideways Range

GBPJPY – 4- Hour Chart – Sideways Range