Good Day to Trade US Dollar Currency Pairs!

Good Morning!. We just had another amazing day with three trading signals on Crude Oil, GBPJPY, and USDJPY which closed at take profit. No

Good Morning!. We just had another amazing day with three trading signals on Crude Oil, GBPJPY, and USDJPY which closed at take profit. No worries if you missed these opportunities as we are about to experience another volatile day. Let's take a look at the major fundamentals and hot trade setups for the day.

Top Economic Events Today

Today we need to monitor the economic events coming out from the US.

Great Britain Pound – GBP

Autumn Forecast Statement – At 12:30 (GMT), the Office of Budget Responsibility (OBR) will be releasing the Autumn Forecast Statement. Never heard of it? No worries, let me explain. This document provides an updated economic outlook and previews on the government's budget for the coming year, including expected spending and income levels, borrowing levels, and financial objectives. In addition to this, it also contains comments on the latest independent economic forecasts prepared by the OBR.

The Impacts?

As we know, the spending and borrowing levels of domestic government have a vital influence on the economy. Increased spending creates work opportunities for contractors and creates jobs. On the flip side, the borrowing levels impact the nation's credit rating and provide insight into the nation's underlying fiscal position. Thus, it helps us determine the money supply in the economy to position for swing trades.

US Dollar – USD

It's a USD day as most high impact economic events are related to the dollar.

Core Durable Goods Orders m/m – Today at 13:30 (GMT), the Census Bureau will be releasing the core durable goods orders with a forecast of 0.4% which is lower than the previous 0.7%. At the same time, Durable Goods Orders m/m are also expected to downbeat with a forecast of 0.4% which is lower than 2% in previous month.

Unemployment Claims – The jobless claims are coming out along with the durable goods. These are expected to be good with a forecasted figure of 241K lower than 249K during the previous week. Honestly, I'm not expecting much movement.

FOMC Meeting Minutes – Later at 19:00 (GMT), the Federal Reserve will release the Nov. 1 policy meeting. The Fed is expected to hike the Fed Fund Rate at its December meeting.

The Impacts?

The USD is likely to stay supported on the release unless the FOMC surprises the market with dovish remarks. At the moment, the interest rate sentiment is prevailing the market and keeping the dollar on the top. Most of the rate hike sentiment is already "priced in" therefore, the change in Fed's tone will cause some serious turbulence in the USD. Check out more on our Weekly Preview update.

Top Trade Setups Today

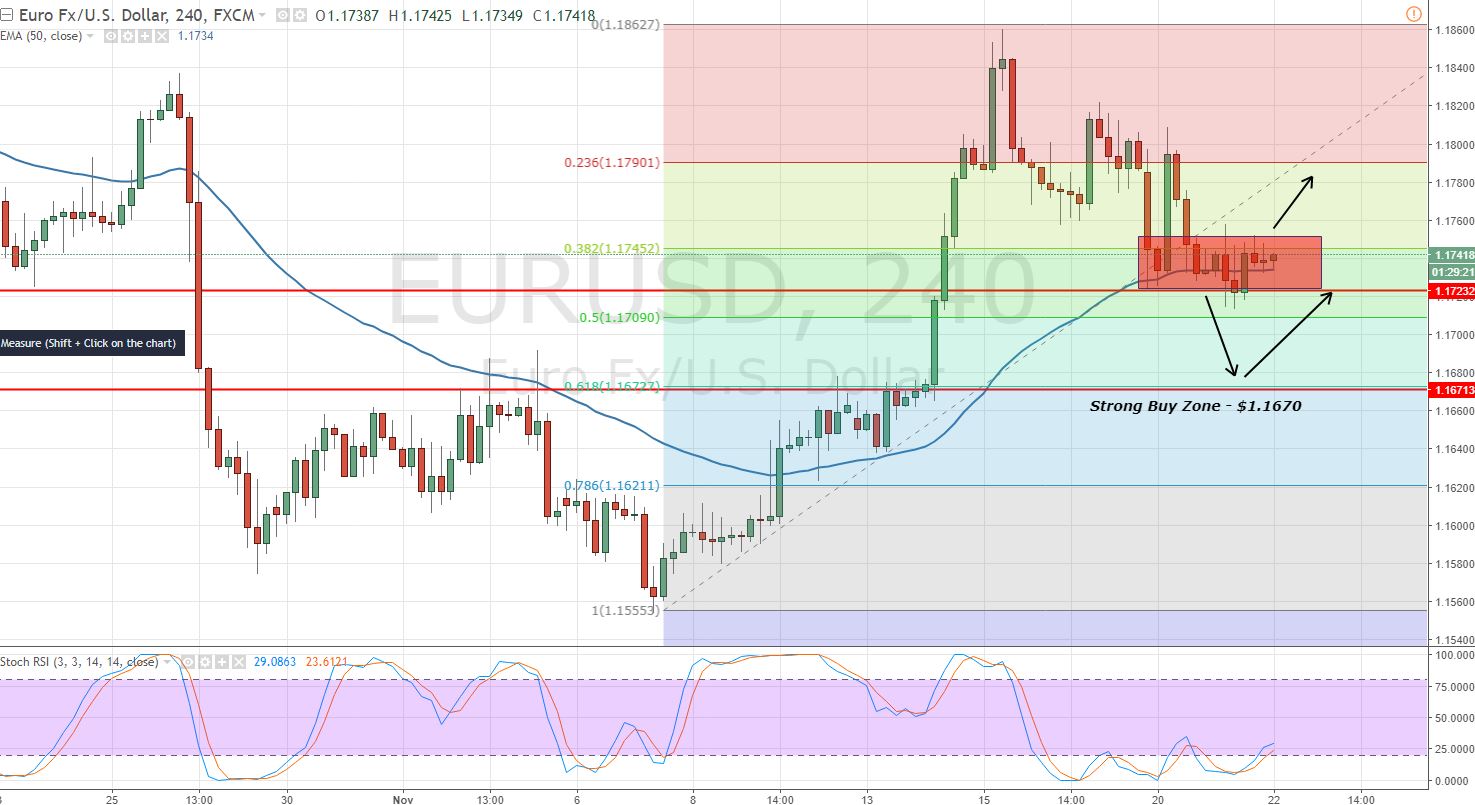

EUR/USD – Consolidation In The Tight Range

The major currency pair has not traded a lot. It's still consolidating in a small trading range of $1.1720 – $1.1750. It's forming a number of neutral candles which are clearly signaling the indecision between buyers and sellers.

EURUSD – 4-Hour Chart – Sideways Range

EURUSD – 4-Hour Chart – Sideways Range

For the moment, we need to eye on a solid support level of $1.1720. Break below this level is likely to drag the pair towards $1.1670 and $1.1620. That's where I would like to take a buy position.

EUR/USD – Key Trading Levels

Support Resistance

1.1714 1.1759

1.1691 1.1781

1.1669 1.1804

Key Trading Level: 1.1736

EUR/USD Trading Plan

The idea is to stay bullish above $1.1675 and $1.1625 with a stop loss below $1.1580 and take profit of $1.1720 and $1.1770. Whereas, selling is recommended below $1.1715 for a target $1.1670.

Keep following FX Leaders for more trade ideas and trade carefully as the market can exhibit unexpected fluctuations. Good luck and have a profitable day!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

EURUSD – 4-Hour Chart – Sideways Range

EURUSD – 4-Hour Chart – Sideways Range