Nov 29, Five Events To Trade Today – EUR/USD In Focus!

The global financial markets rose and fell during the New York trading session when the Conference Board’s consumer confidence gauge rose more than expected. The volatility isn't over just yet. We have some high impact economic events ready to shake the market today.

Top Economic Events Today

Eurozone – EUR

German & Spanish CPI – The day begins with Inflation figures from Germany and Spain. Destatis will be releasing the Spanish inflation at 8:00 (GMT). The time for Germany's inflation report release isn't given yet. Both of the figures are expected to improve on the previous one.

Great Britain Pound – GBP

BOE Gov Carney Speaks – Today at 14:00 (GMT), Mark Carney is due to speak about the Fair and Effective Markets Review at the Fixed Income Currencies and Commodities Markets Standards Board, in London. I'm not expecting much volatility over this event.

However, Net Lending to Individuals m/m is expected at 9:30 (GMT) and it's likely to cause slight volatility in the Sterling pairs. This figure shows the change in the total value of new credit issued to consumers.

U.S. Dollar – USD

Prelim GDP q/q – Here comes the Chief. The Bureau of Economic Analysis will release the GDP figures at 13:30 (GMT). The GDP is expected to increase by 3.3% which is higher the figure of 3%.

The dollar is likely to remain supported due to the positive forecast and most of the release is already "priced in". Though, the game isn't over yet.

Fed Chair Yellen Testifies – At 15:00 (GMT), Yellen is scheduled to testify on the US economic outlook before the Joint Economic Committee of Congress, in Washington DC.

We need to pay attention to her views on economic conditions because she tends to drop subtle clues regarding future monetary policy. We need to see if she talks about anything related to a December interest rate hike which is expected and already priced in.

Top Trade Setups To Watch Today

EUR/USD – Moving Average Retest

The major currency pair EUR/USD plunged sharply after the CB Consumer Confidence measure rose to 129.5 in the month of November from 126.2 in October, beating the forecast of 124.

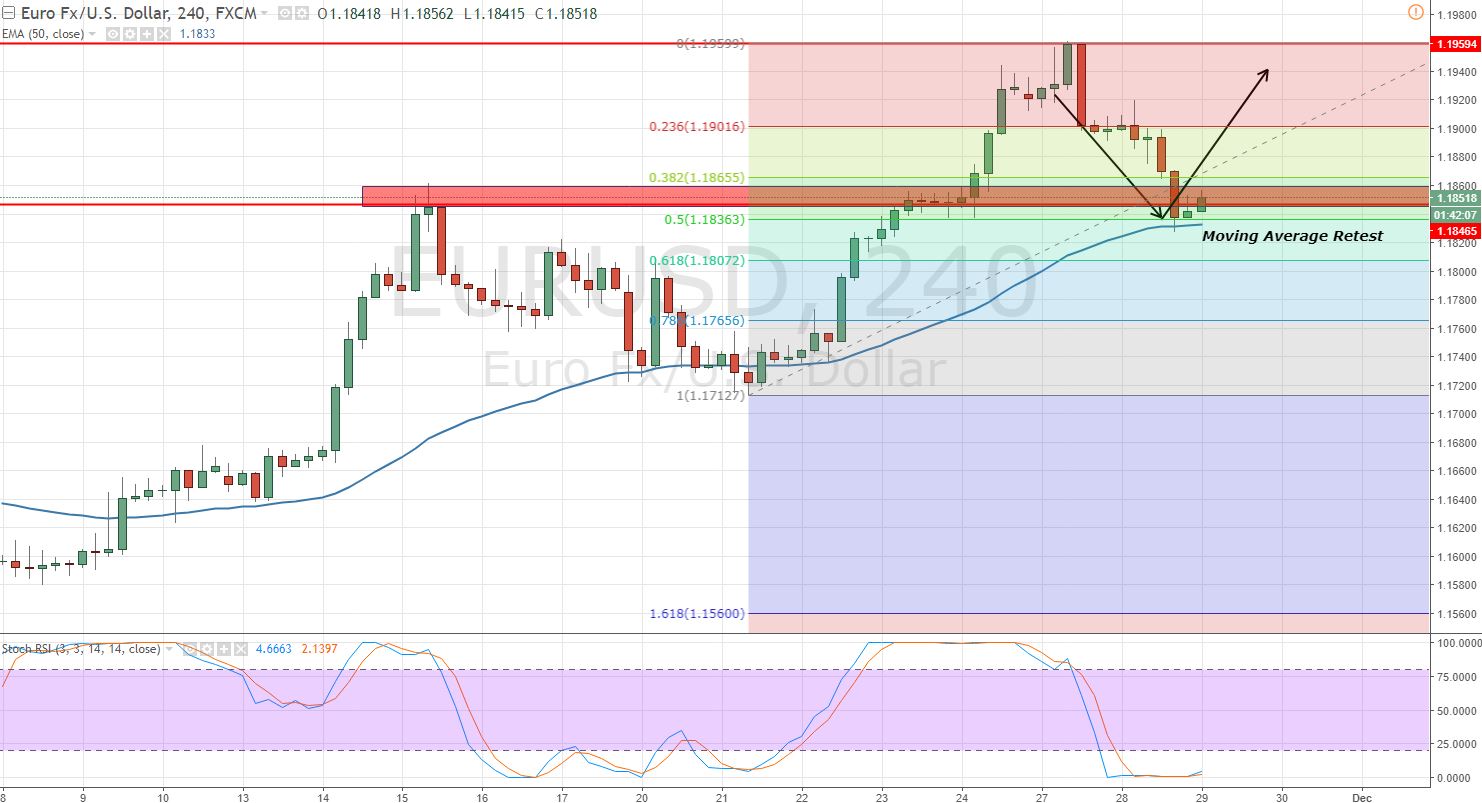

EURUSD – 4- Hour Chart – Moving Average Retest

EURUSD – 4- Hour Chart – Moving Average Retest

Taking a look at the EUR/USD chart, the pair finally got some support at $1.1835 for three reasons:

- The EURUSD prices are testing the 50- periods moving average on the 4-hour chart. The candles closing above EMA are signaling a potential bullish reversal in the pair. ?

- The EUR/USD completes the 50% Fibonacci Retracement exactly at the same level, $1.1835. Breakage below this level can lead the pair towards the 61.8% Fibo level of $1.1800.?

- The Stochastic and RSI are dramatically oversold and may force bears to come out of the market.

EUR/USD – Key Trading Levels

Support Resistance

1.1806 1.1899

1.177 1.1956

1.1713 1.1992

Key Trading Level: 1.1863

EUR/USD Trading Plan

I'm looking to stay bullish above 1.1835 with a stop below $1.1790 and a take profit of $1.1900. Good luck fellas, and keep following us for commentary on economic events. Check out our Forex Signals Brief for Nov. 29 for more insights about our Forex Trading Signals.

EURUSD – 4- Hour Chart – Moving Average Retest

EURUSD – 4- Hour Chart – Moving Average Retest