WTI Crude Oil Standstill – Inventories Awaited!

It was a nice trade in the Crude Oil yesterday as the trading signal closed at the target. Today, we may experience another wave of volatility during the New York session due to the economic events. Buckle up …

API Inventories Report

In our previous update Is It Good Time To Buy Falling WTI Crude Oil, we shared our forecast about API inventories. The US Crude Oil inventories rose by 1.8 million barrels last week to 457.3 million barrels.

EIA Crude Oil Inventories

At 15:30 (GMT), the Energy Information Administration will be releasing the inventories figures. It's expected to report a draw of -2.5M but considering the API report, we can expect a build rather than draw.

Quick Technical Review

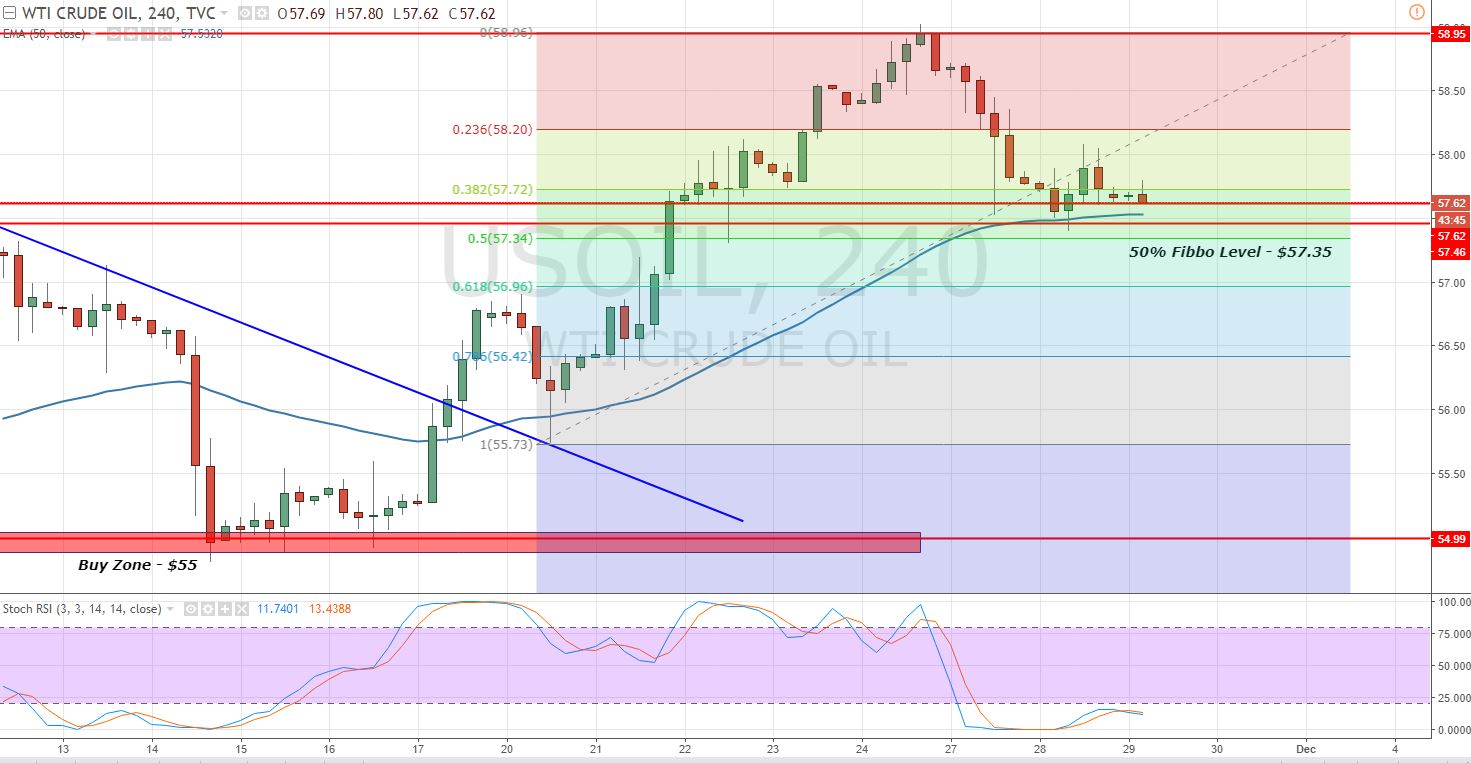

Crude Oil tested $57.70 twice but finally broke below this level after the release of API Report. Fortunately, we closed our signal in profit ahead of the news release.

Crude Oil – 4 – Hour Chart – Fibonacci Retracement

Crude Oil – 4 – Hour Chart – Fibonacci Retracement

Now, the leading indicators are coming out of the oversold zone which means bears are exhausted. But the Doji candles are suggesting neutral sentiment of investors. Well, just like us, the traders around the globe are waiting for the EIA report.

WTI Crude Oil – Trading Plan

I'm going to wait for news, but for the sake of an idea, I will be closely looking at $57.25 to enter a sell position or to stay bullish above it. Stay tuned as we may share a trading signal during the New York trading session today.

Crude Oil – 4 – Hour Chart – Fibonacci Retracement

Crude Oil – 4 – Hour Chart – Fibonacci Retracement