EUR/JPY Knocked Us Out – Retail Sales Out & Inflation Awaited!

Euro begins the day bullish despite the unfavorable fundamentals. We shared a forex trading signal on EUR/JPY, but unfortunately, it did no

Euro begins the day bullish despite the unfavorable fundamentals. We shared a forex trading signal on EUR/JPY, but unfortunately, it did not get profit for us. Anyhow, that's what I'm looking to trade now…

German Retail Sales

Destatis just released the retail sale figures and as per provisional data turnover in retail trade missed forecast. It dropped sharply by 1.2% while it was forecasted to gain by 0.3%.

Are you wondering why Euro is getting stronger despite unfavorable data? It seems like investors are pricing in the positive inflation forecast. Settle down to trade CPI Flash Estimate y/y at 10:00 (GMT).

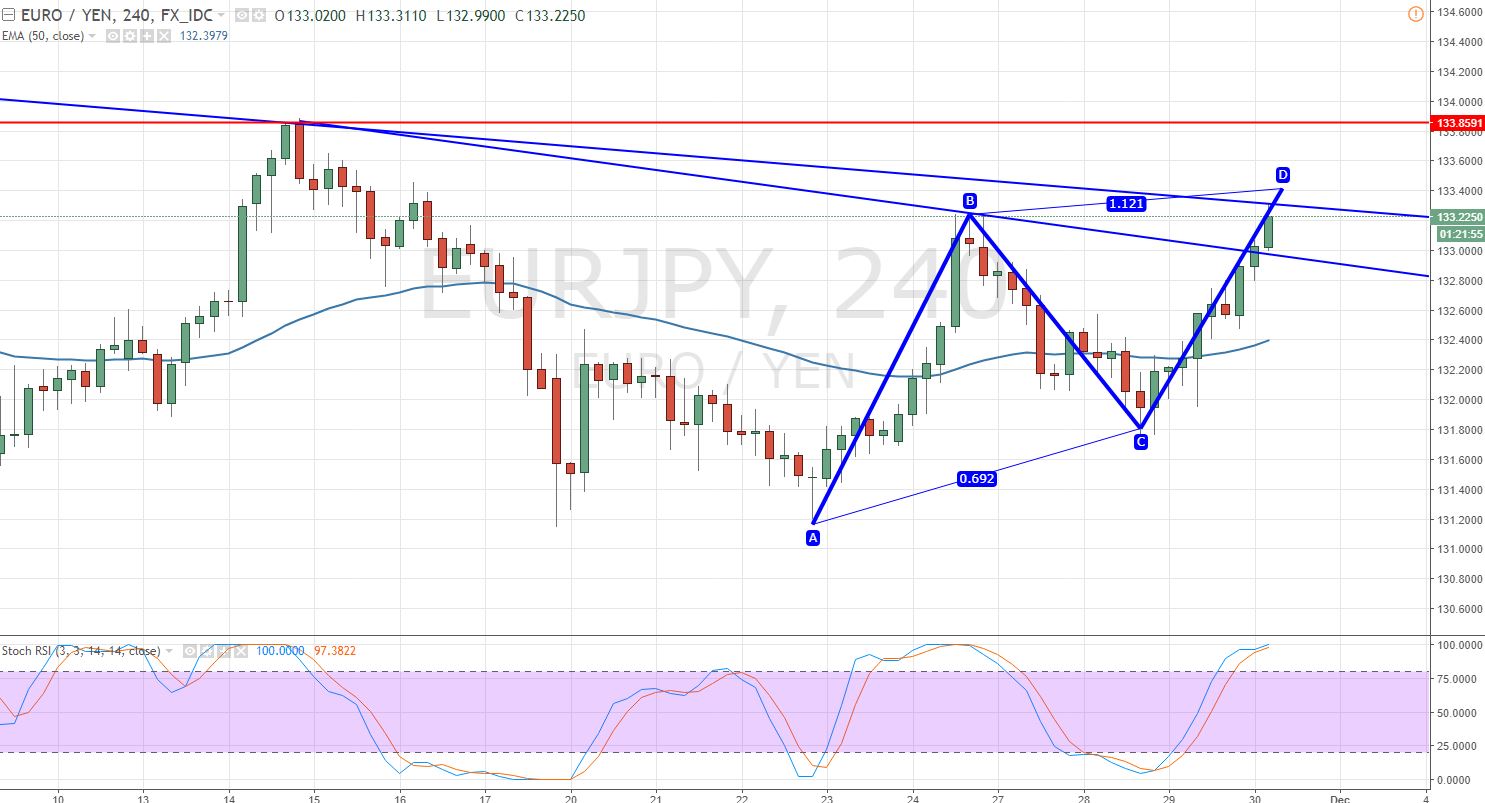

EURJPY – Bearish Trendline Retest

Fellows, check out this bearish trendline on the 4-hour timeframe of EUR/JPY. It's providing strong resistance to the pair at 133.250. Unfortunately, the high volatility knocked us out as our stop loss was at 133.300.

EUR/JPY – 4-Hour Chart – Playing With Trendline

EUR/JPY – 4-Hour Chart – Playing With Trendline

Now, the leading indicator Stochastic is trading at 100. Seems like we should take another sell below $133.300 but this time with a stop loss on a bit higher side.

Support Resistance

132.06 132.98

131.5 133.34

131.14 133.9

Key Trading Level: 132.42

EURJPY – Trading Plan

I'm placing to re-enter my sell position below 133.300 with a stop above 133.500 and take profit at 132.700 and 132.500. But I'm waiting for the more technical confirmations and CPI report. Stay tuned for more updates on it.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

EUR/JPY – 4-Hour Chart – Playing With Trendline

EUR/JPY – 4-Hour Chart – Playing With Trendline