Rollercoaster Bitcoin – BTC Fell 24.30% In a Single Day!

What's up, traders. FX Leaders team is regularly updating the Bitcoins. Seems like the Cryptocurrencies aren't meant for small traders. A d

What's up, traders. FX Leaders team is regularly updating the Bitcoins. Seems like the Cryptocurrencies aren't meant for small traders. A day before it achieved a landmark of an all-time high around $11,500 but it was short lived. Check out the remarks from the vice president of the European Central Bank (ECB).

ECB Vice President – "It’s a very particular asset, it’s a speculative asset by definition looking to the developments in its price. Investors are taking that risk of buying at such high prices."

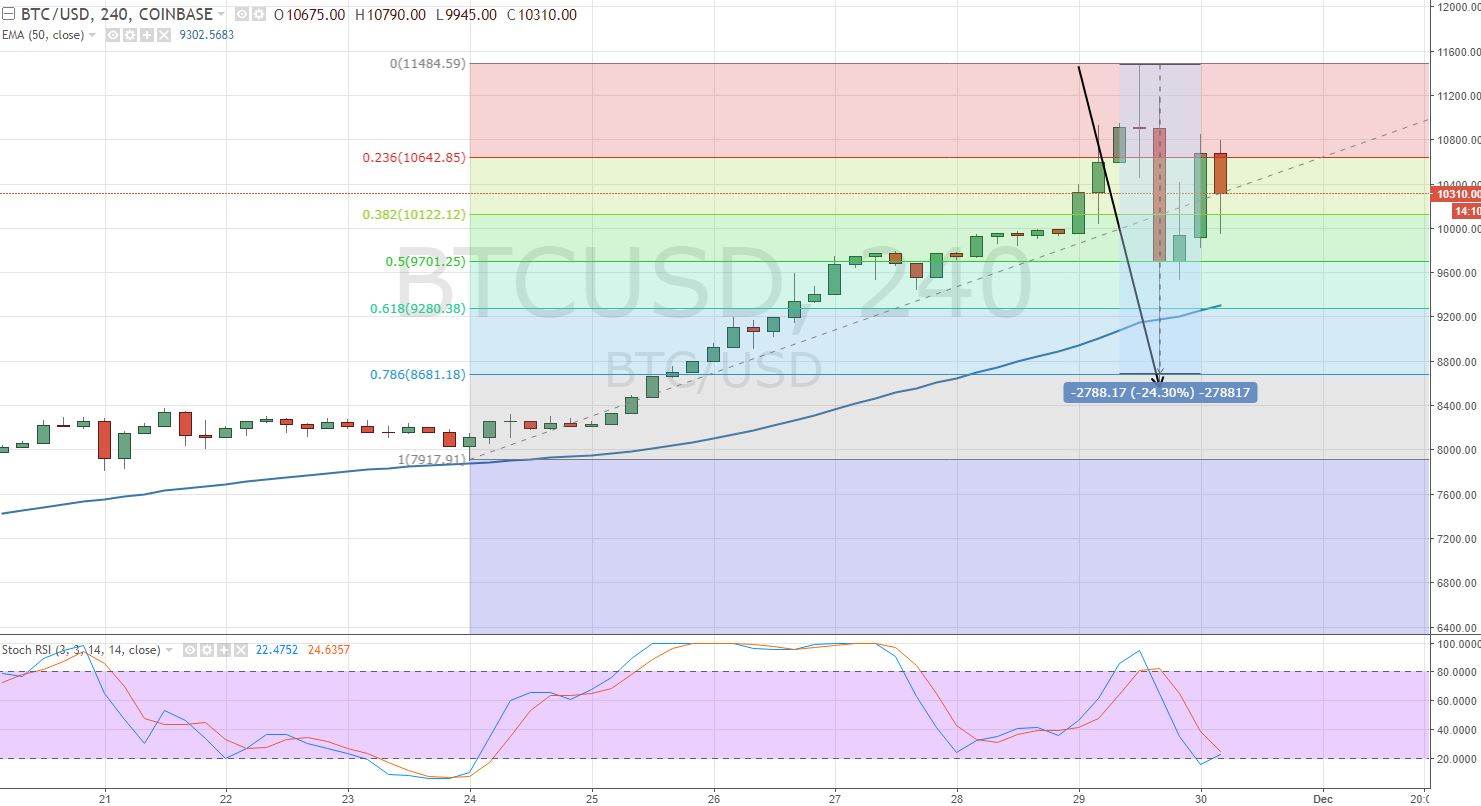

Looking at the graph, the digital currency set a new all-time high nearby $11,500 but soon reversed to drop nearly $3,000 to a low of about $8,500.

Technical Outlook – BTC/USD

For technical traders, it didn't come as a surprise as they were expecting something like this to happen with Cryptos. For instance, looking at the chart, BTC/USD was in a massively overbought region.

BTC/USD – 4-Hour Chart

BTC/USD – 4-Hour Chart

At some point near $11,500 landmark, the bulls tried to take profit which formed a spinning top candlestick pattern on the 4-hour chart. Here, the sellers couldn't resist selling the BTC and it fell nearly 24.3% in a single day.

Bitcoin has completed the 78.6% retracement at $8,681 and now it's holding above the same. Honestly, it's really hard to say what's going to happen with Bitcoin in next couple of hours. Whether it will go for placing another all-time high or it will flash lower to destroy the bulls. Regardless of the volatility, the bulls are very likely to buy cheaper Bitcoins for quick gains.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

BTC/USD – 4-Hour Chart

BTC/USD – 4-Hour Chart