Dec 6 – Quiet before the Storm – ADP Non-farm Ahead

We kicked off the week with seven take profits and two stops so far. Isn’t it exciting? Today, the market is likely to remain highly volatile than a day before. We have some really hot economic events on the docket. Let’s see how to make it work out for us!

Top Events To Watch Out Today

Eurozone – EUR

German Factory Orders m/m – Today at 7:00 (GMT), Destatis is expected to release the German factory orders data. The orders are expected to fall by -0.2% vs. 1% gain in the previous month. Since German is the main business hub of Eurozone, we may see some weakness in Euro on negative news and vice versa.

U.S. Dollar – USD

ADP Non-Farm Employment Change – The Automatic Data Processing, Inc. will be releasing the ADP Non-Farm Employment Change at 13:15 (GMT). It’s expected to drop to 189K vs. 235K in the previous month.

The ADP figure is mostly correlated with the Non-farm payroll and it’s often called advance NFP. The negative forecast will be weighing the dollar till the release of news. Whereas, the actual ADP will give us clues about labor market figures due on this Friday.

Crude Oil Inventories are one of the most important events to trade the Crude Oil & Canadian currency. We need to keep an eye on it on 15:30 (GMT) and forecasted to show a draw of -3.2M.

Canadian Dollar – CAD

Overnight Rate – Folks, BOC will be releasing interest rate decision today at 15:00. However, it’s not expected to change it. But after they hike the interest rate in Sep from 0.75% to 1%, we can expect anything from BOC. So, put your put your seatbelt on and ride the volatility.

Top Trade Setups To Watch Today

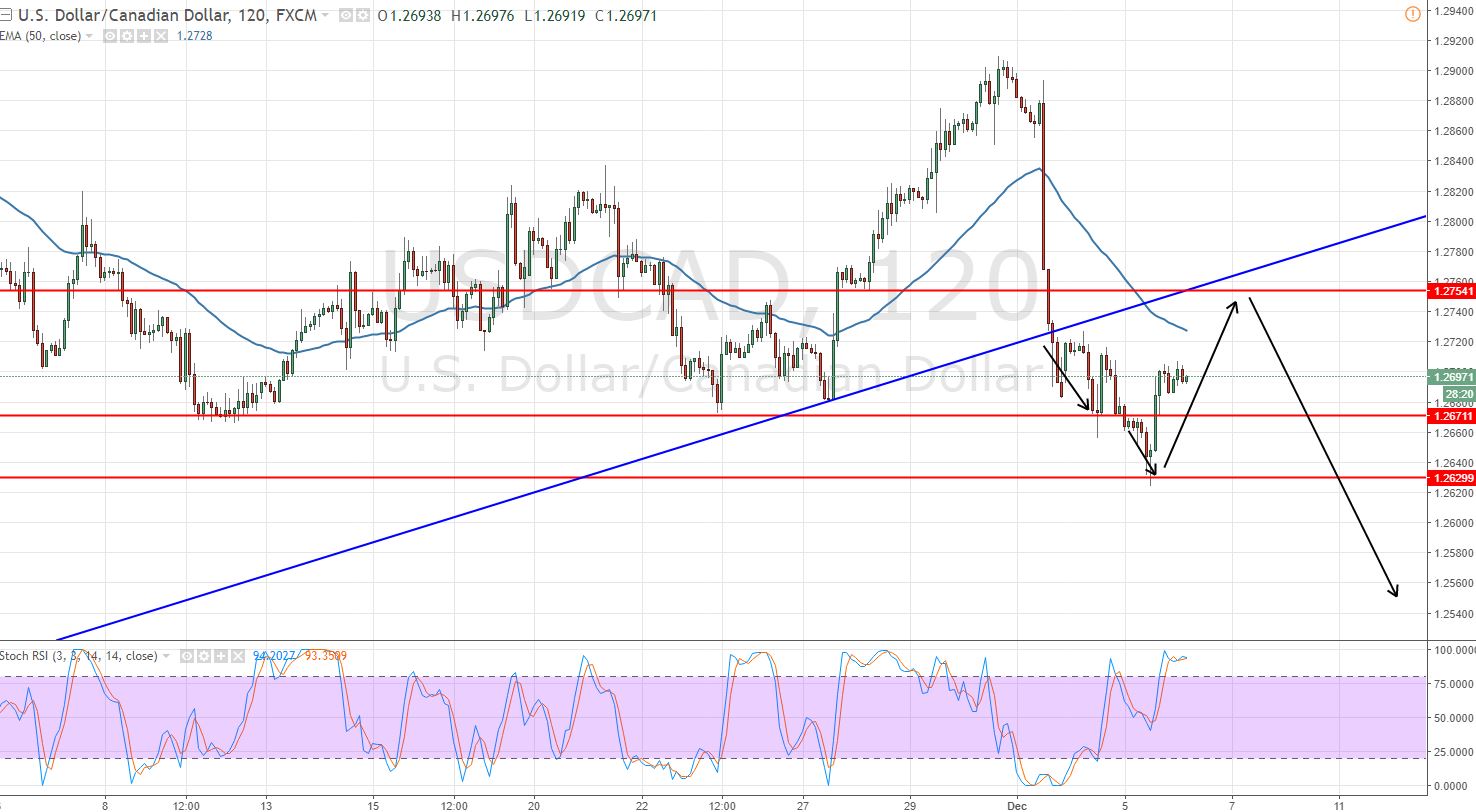

USD/CAD – Bears Gains Momentum

Yesterday, in our morning brief we discussed that the major currency pair was oversold enough to get CAD a pullback. That’s exactly the pair traded. Now, the pair gained support at 1.2630, the horizontal trendline area.

USDCAD – 120 Min Chart

The pair is still trading below 50- periods EMA which demonstrates the selling sentiment of investors. While the leading indicators RSI and Stochastics have entered the overbought region at 80.

USD/CAD – Key Trading Levels

Support Resistance

1.2637 1.2724

1.2583 1.2757

1.255 1.2811

Key Trading Level: 1.267

USD/CAD Trading Plan

Fellas, I’m keeping an eye on two levels today. Firstly, 1.2670 is a crucial trading level and above this, the pair can go for 1.2730 and 1.2760. On the flip side, below the 1.2760, the market can extend its bearish trend to new lows. Now it depends upon the news. Good luck and trade with great care!