How Can BOE Monetary Policy Impact GBPUSD Today?

FX junkies are really excited for another day with some hot news coming their way. Check out our Dec 14 - Morning Brief for more detailed...

FX junkies are really excited for another day with some hot news coming their way. Check out our Dec 14 – Morning Brief for more detailed review and insights on these events. In this update, I’m going to share some trade setups worth watching today.

GBP/USD – BOE Monetary Policy Awaited

Cable traded in line with our previous forecast given shared in Top Trade Setups. Just like a day before, the Cable will decide it’s direction based on two reasons today:

– MPC Official Bank Rate Votes at 12:00 (GMT)

– Official Bank Rate – 12:00 (GMT)

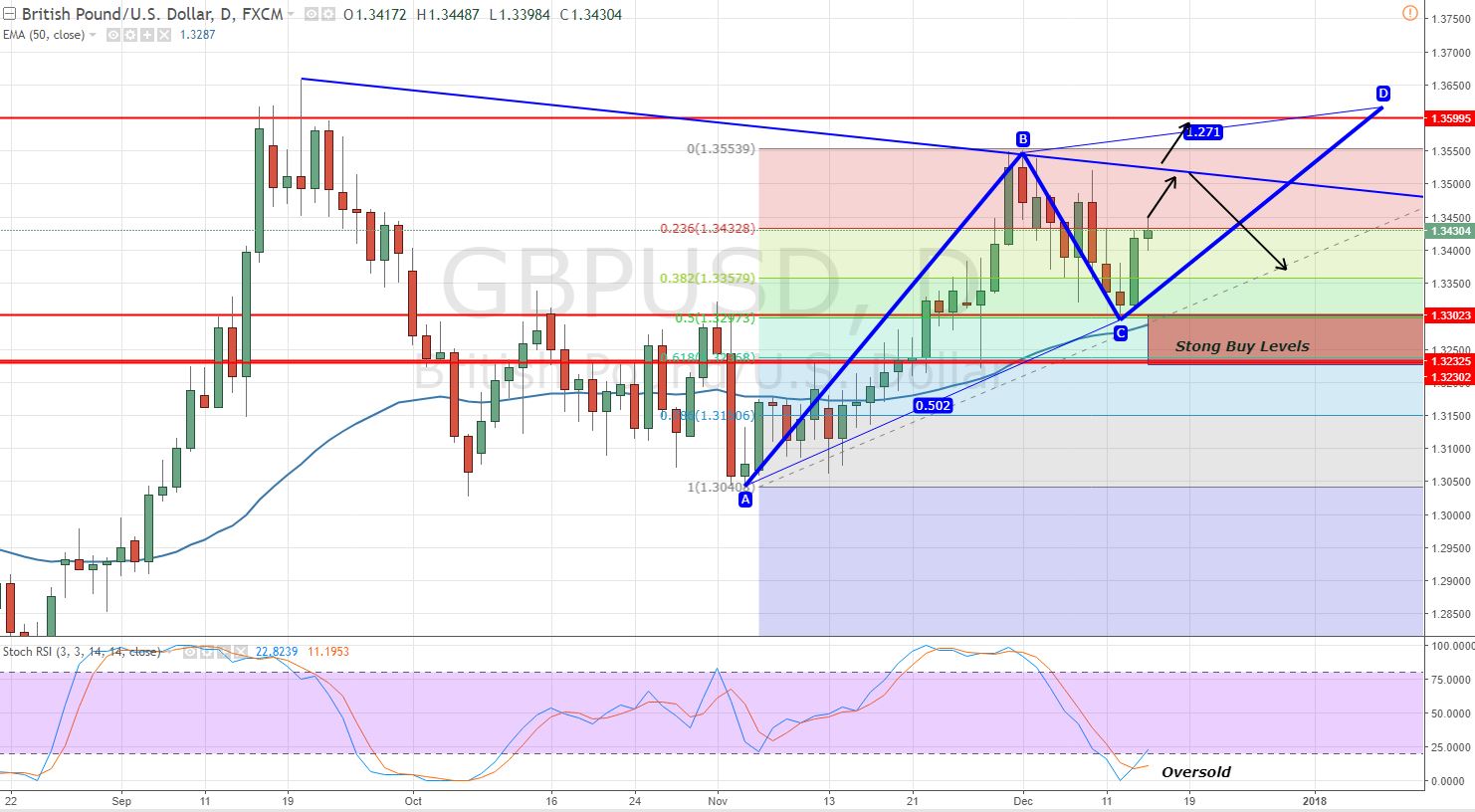

The Bank of England is expected to keep things as it is with playing much with interest rates or voting. Technically, the pair is giving a bullish view. Remember the ABCD pattern that we discussed yesterday. The pound is heading north now after completing B to C leg at $1.33 (50% Fibo level).

GBPUSD – Daily Chart

Investors are recommended to enter a buy at point C to target 1.3500. Check out these support and resistance levels.

GBP/USD – Key Trading Levels

Support Resistance

1.3342 1.3458

1.3268 1.35

1.3226 1.3574

Key Trading Level: 1.3384

How Can BOE Monetary Policy Impact?

The BOE is widely expected to keep the rates unchanged. Since the earlier rate hike is already fully priced in and investors aren’t expecting any surprise today, therefore we can expect neutral to bearish movement in the GBP/USD today.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account