EUR/JPY Breakout the Long Range – Potential Swing Trade

A couple of weeks ago, we discussed the wide trading range of the EURJPY. The cross currency played in a range (131.560 - 134.400) for...

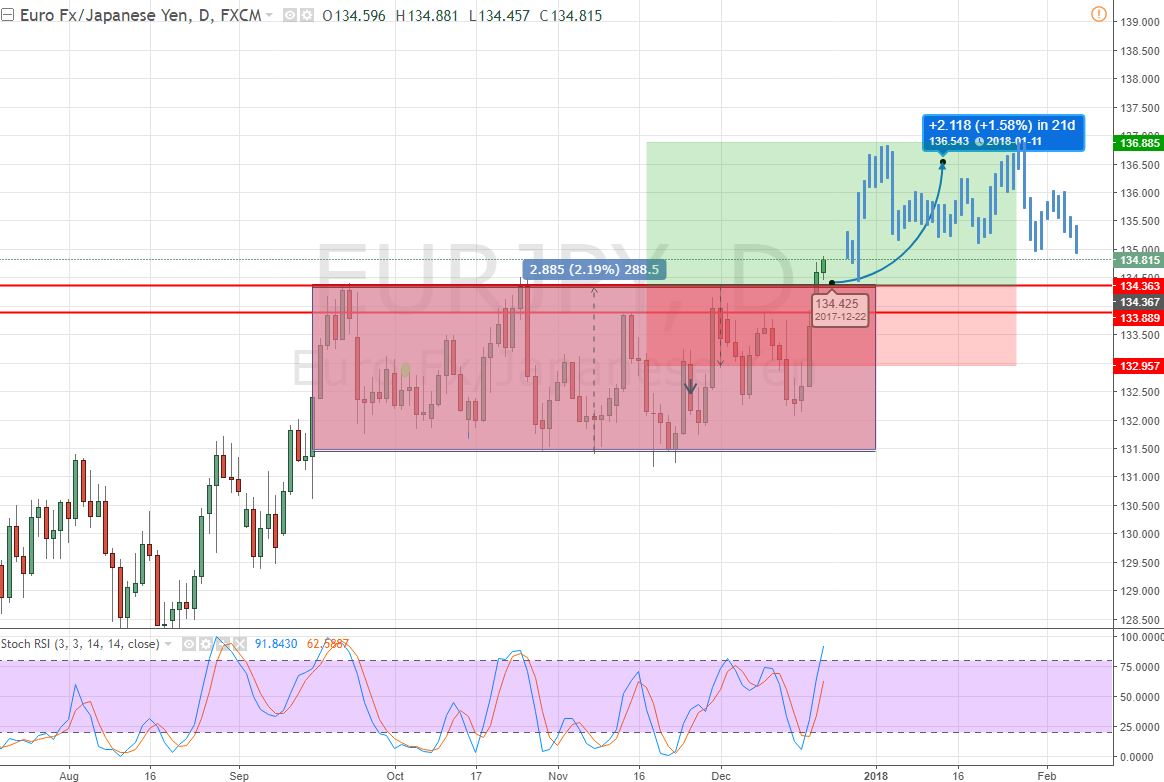

A couple of weeks ago, we discussed the wide trading range of the EURJPY. The cross currency played in a range (131.560 – 134.400) for a couple of months starting from Sep to mind Dec. Now, let’s look at the potential long-term plan for EUR/JPY.

EURJPY – Wide Range Breakout

Check out the weekly chart given below. We can see, the EURJPY was trading in a long range of 131.550 – 134.500. Yesterday, it had a nice and clear breakout at 134.500. Let’s break down the technical’s supporting the further bullish trend.

EURJPY – Daily Chart

– Three white soldiers in the daily time frame are supporting the bullish bias of investors.

– Yesterday, the daily candle closed outside the previous range, it’s a very first indication of a bullish breakout.

– Stochastic is trading in the buying zone (above 50). It’s signifying a strong bullish trend.

Support Resistance

132.03 133.44

131.6 133.87

130.9 134.58

Key Trading Level: 132.74

EURJPY – Trading Plan

We should wait for bit correction in the pair before entering a buy position. Prefered entry will be near 133.850 with a stop below 132 and take profit at 136. Fellas, it’s a swing trade opportunity, so make sure to follow the money management strategy. Good luck and stay tuned for more updates!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account