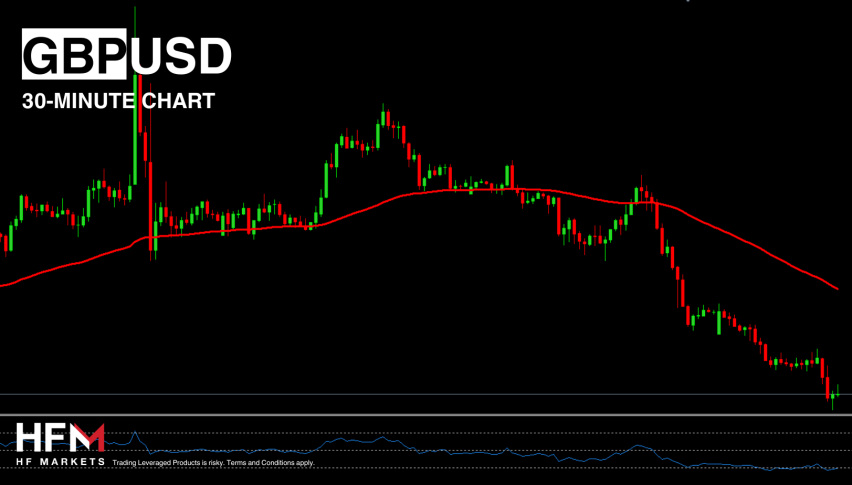

Markets on Monday: The USD on the Defensive

All the headlines over the weekend have been surrounding the US Government Shutdown. Again the two parties couldn’t come to an agreement surrounding the nations budget and ballooning debts, so we ended up with nothing.

However, investors are now a little more cautious when it comes to this type of event. Previously we’d seen wild swings during the Obama Presidency when this previously occurred. This time around, I’m not so sure this is a big deal at all.

There’s no doubt the parties will reach an agreement and it’s really only a matter of time. For the most part, this whole process is just politics and that’s basically what we can take from it.

A weaker USD will, however, continue to spark the majors. It’s a big week ahead for the EUR/USD in particular as we get another ECB decision and more clarity surrounding QE.

USD Weakness

While we might get further USD weakness from the fallout over the US Government, longer-term this isn’t going to make a material difference.

Despite all the politics, I’m still bearish on the USD in the short-term and I’m expecting us to have a good look at the 90.00 level in the very near future.