Markets on Tuesday: The Government is Back, But the USD is Still Down

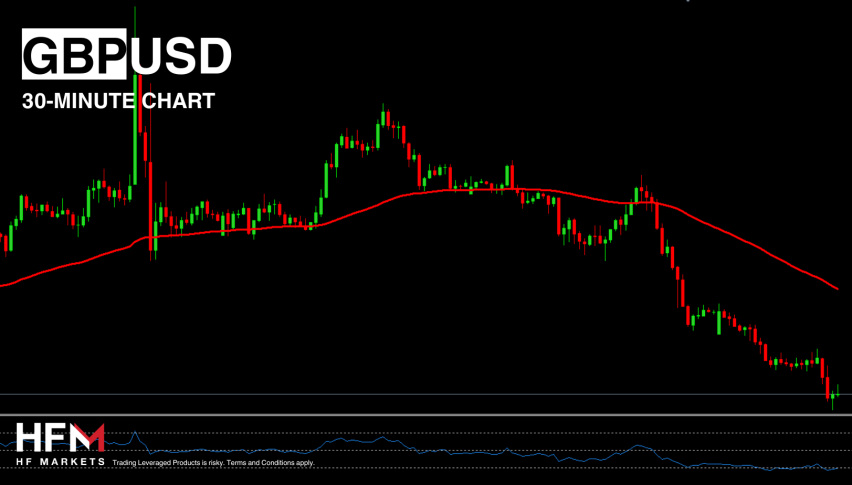

As we suggested yesterday, the whole saga of a Government shutdown is now just becoming another day in politics. Many might even call it a case of the boy who cried wolf. As such when a deal was again struck, there was a modest bounce in the USD, but as you can see on the charts, we are still very much in the depths of a strong downtrend.

Even with a bit of strength, there was a big move higher in the pound. The GBP/USD was up nearly 1% on the day in what has been an unrelenting move higher. The USD/JPY also rallied a touch on the news. The Yen will be in focus today as we have the Bank Of Japan (BoJ) Interest Rate Statement. We’ll get a better idea about their overall monetary policy and whether or not they will maintain their easy monetary policy – which they likely will.

Bitcoin (BTC) was also one of the big movers in trade yesterday. We have now started to give up all of last week’s gains and are back testing support levels. The 10,000 level is the big one and if we can crack that, look out below.

Dollar to Dive?

Despite the good news, the USD is still weak. I am waiting for a test of 90.00 and the chart looks to be consolidating. To me, that is a classic sign of more downside to come.

I would be looking to be a seller when price is nearing the 91.00 mark. So effectively sell the bounce, if, in fact, we can bounce from here.