Markets on Friday: USD Holds Up as Stocks Plunge

Markets are back in panic mode as we’ve seen some more big selling in US equity markets.

Markets are back in panic mode as we’ve seen some more big selling in US equity markets. The Dow Jones and S&P 500 were both down around the 4% mark which is the second big move that we’ve seen.

Much of the downside has been linked to volatility products and the pending rise in interest rates. Investors are scrambling to cover their positions and markets are tumbling as a result.

The majors all made some decent moves as well but nothing like we’ve seen in stocks. The USD has risen and we are seeing some flows towards the safe haven currencies. The USD/JPY and USD/CHF are two of the biggest beneficiaries when markets get scared. The USD/JPY is back attacking key support and if it holds will depend largely on US equity markets in my opinion.

Bitcoin (BTC) continued its recovery with the fledgeling digital currency now attacking the next resistance level which stands at 9500. It’s been a strong recovery after what was a very big sell-off.

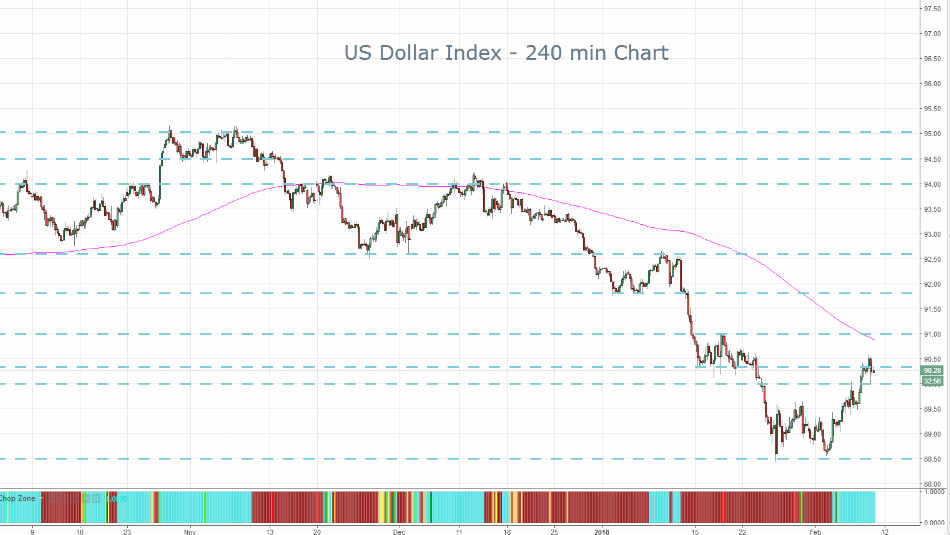

USD Testing Resistance

The USD is still battling with resistance. The trend is now certainly to the upside and the bottom looks to be in place.

Yesterday I spoke about the 90.33 level and what that meant to the USD. This is really the start of an area of resistance that we need to crack. If we can push through then we will start to see a bigger turnaround.

That said there is plenty of work to do to get through the 91.00 region as there is clearly an area of high volume that will cause a fair bit of back and forth price action.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account