Markets on Monday: Is There More Volatility Ahead?

February has so far marked an unprecedented increase in volatility on worldwide equity markets.

February has so far marked an unprecedented increase in volatility on worldwide equity markets. I only say unprecedented because for a few years now we really haven’t seen any type of significant sell-off.

Last week the S&P 500 ended down 5% and there looks to be more downside on the horizon.

At the same time, the US Dollar is finding some strength and that is translating to the other majors. This week one of the key economic data points will be US CPI. One of the driving factors in the turnaround of the USD has been to pending rate hikes.

That has added to an already shaky US stock market and if in fact, we see a strong print, that means we are more likely to have interest rate hikes ahead. The Fed has suggested that there might be three on the horizon. A good number will help that.

And despite the fact that high rates generally correlate to strong stock markets. We might just see more pressure on stocks in the coming five trading sessions.

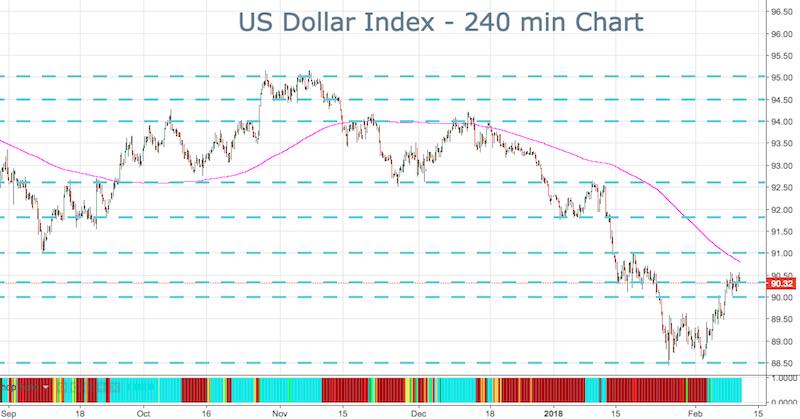

USD Testing Resistance

The USD is now pulling into the upper range that I spoke about last week. The bottom being the 90.33 area and the top looks to be 91.00. Any hint of a rise in inflation (and hence rates) will see a jump to the top end of that region.

Around the 91.00 level, we also see what looks like a head and shoulders pattern in the USD so that is another technical indicator of more upside to come.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account