Top 2 Reasons to Sell WTI Crude Oil Today

Technically, the WIT Crude Oil continues to consolidate below $61.15. We can see the Crude Oil has failed a number of times to break the...

WTI Crude Oil Price is mostly flat today due to solid global demand vs. ongoing concerns over rising global supply levels. We have opened a sell signal on Crude Oil for one of two reasons.

Two Reasons Behind Bearish Oil

EIA Crude Oil Inventories – Yesterday, the EIA reported a build of 5M barrels vs. 2.2M inventories beforehand. Besides for that, the OPEC (Organization of the Petroleum Exporting Countries) stated non-OPEC supply extension for 2018 was forecasted at around 1.6M barrels per day compared to 1.4M barrels per day prior. Its efforts to cut the supply continues to fail thus rebalancing the market.

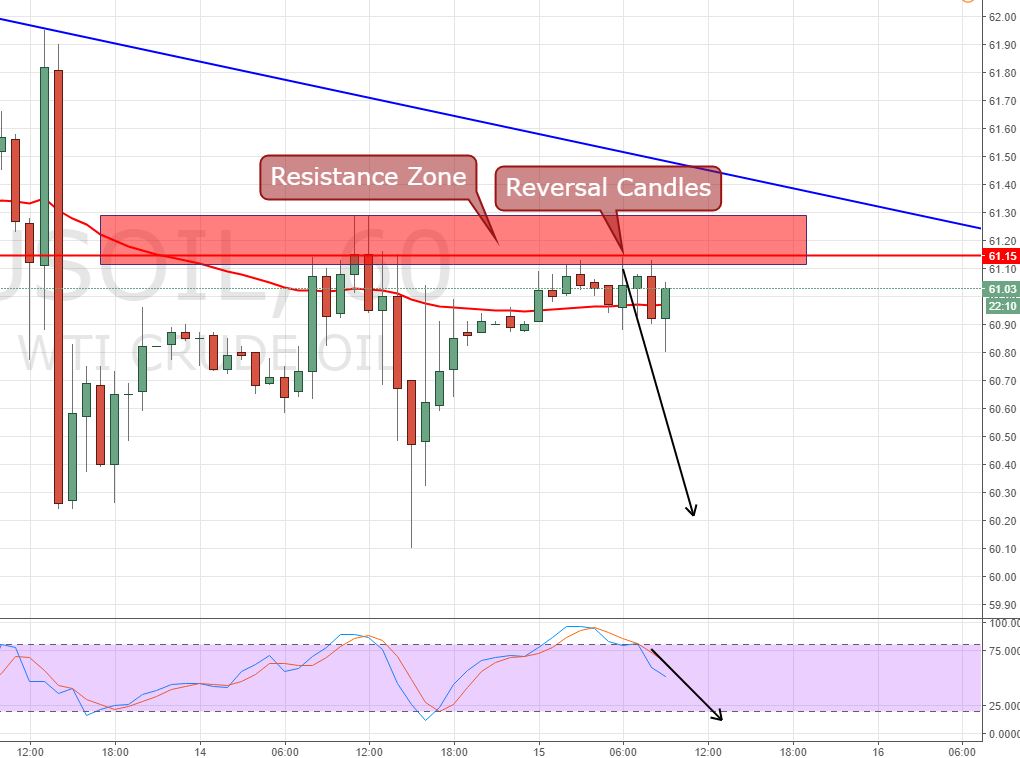

WTI Crude Oil – Hourly Chart

Technically, the WIT Crude Oil continues to consolidate below $61.15. We can see the Crude Oil has failed a number of times to break the 61.15. An interesting part is the number of reversal candles, such as a Doji and Spinning Top, are right below 61.15.

WTI Crude Oil – Trading Plan

Stay bearish below $61.15 with a stop above $61.25 and profit of $60.60.

All the best!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account