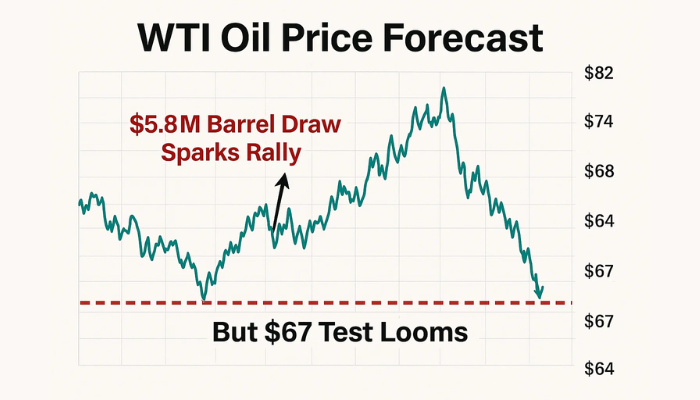

Is Crude Getting Set For a Late Charge?

There were a number of bearish indicators for Crude Oil on Wednesday.

There were a number of bearish indicators for Crude Oil on Wednesday. The key indicator was clearly a surprise build in Oil stocks, that came in higher than anticipated.

At the same time, we saw the USD stage a bit of a rebound and bounce higher by almost 1%. We have to remember that commodities are priced in USD so a move higher is bearish for price.

While stocks also put in a weaker than expected performance. Led mainly by the high-flying tech stocks that took a hit. Crude Oil has a strong correlation to the overall economy and stock market.

Resistance is Strong

The resistance level at 66.00 is sticking out like a sore thumb at the moment. Every man and his dog can see it and probably thinks the same thing.

When we get into a situation like that I tend to want to try something different. Instead of selling on a test of resistance, I’m actually tempted to long for a move back into resistance.

These big levels suck price towards them. So if we can start getting some upward momentum on Thursday then I would be looking to buy with a target very close to 66.00.

So when everyone is scrambling to enter, I’ll be looking for the door.

Crude Oil – 240 min Chart.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account