Gold On Fire – China Boost Safe Haven Appeal By 25% Tariff

Chinese finance ministry confirms 25% tariff on the US goods, which triggered the safe haven appeal in the market. US indices are down by...

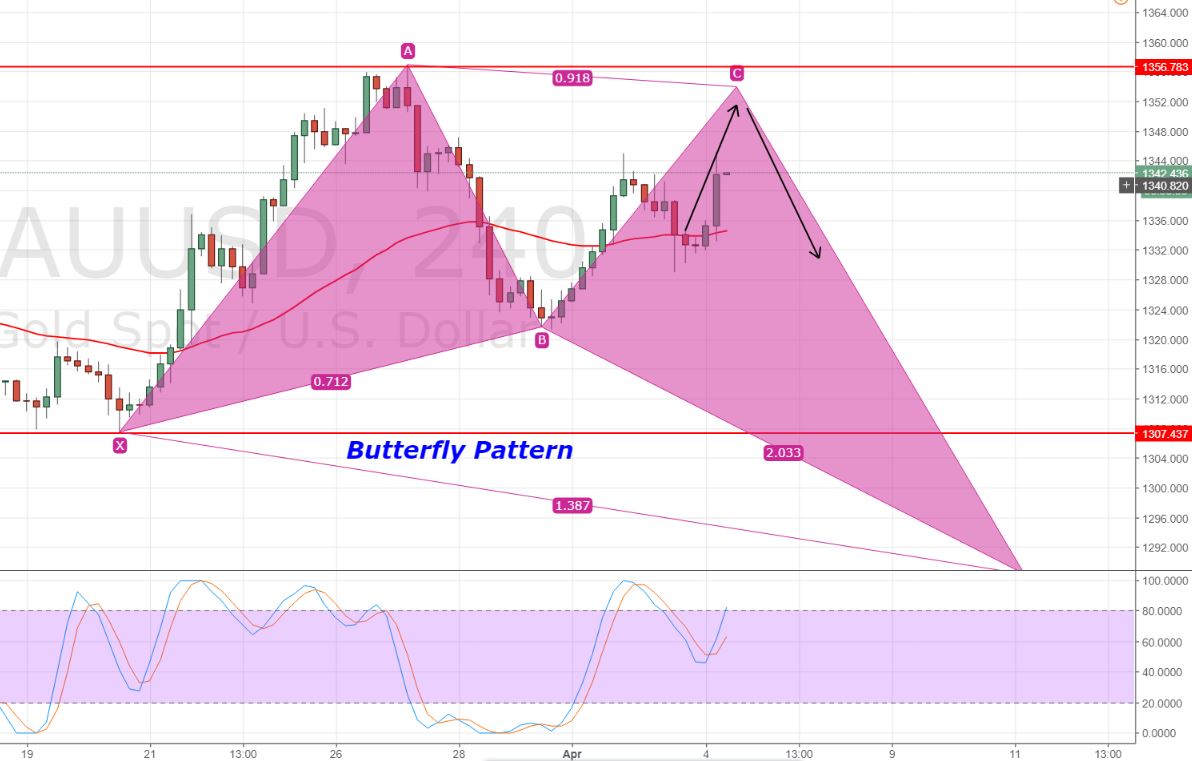

Chinese finance ministry confirms 25% tariff on the US goods, which triggered the safe haven appeal in the market. US indices are down by 1.39% while the bullion market is skyrocketing with 0.70% gain. I just spotted a butterfly pattern which is likely to give us a really nice position…

Gold – XAU/USD – Key Technical Points

On the 4-hour chart, Gold has formed a butterfly pattern which is really making Gold fly towards $1,356. You can see on the chart below, the pattern has completed A to B movement near $1,320 and now B to C movement is on the cards.

Gold – 240 Min Chart

The C point stays near $1,356 and as soon as the market completes B to C wave, the Gold is expected to take a big dip to $1,300 and even below. However, you should keep in mind the US NFP which is due on Friday and will be a key player.

Gold – Trading Idea

The idea is to stay bullish above $1335 with a stop below $1330 and a take profit at $1,344. The break above $1,344 is likely to give us further buying until $1,352. Brace yourself for the action.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account