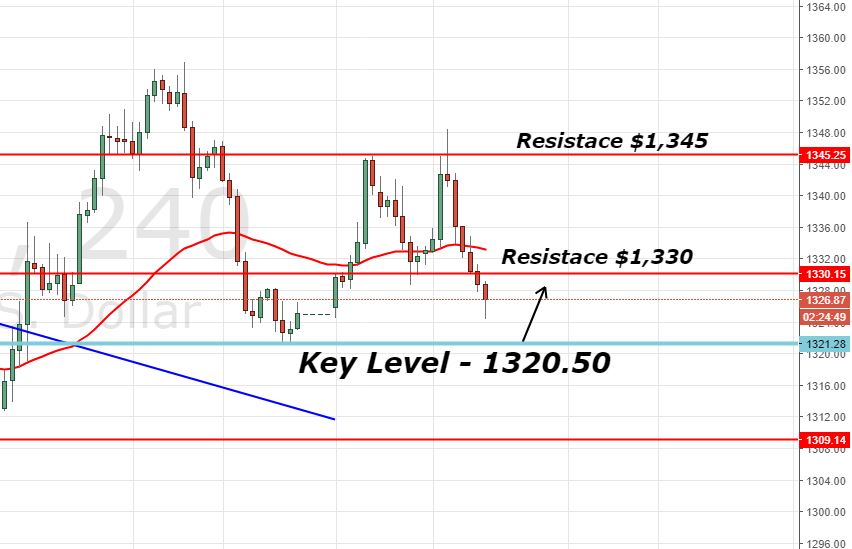

Gold Sinks Below $1,330 as The Market Recovers Risk Appetite!

Despite the uncertainty created by the US and China with the exchange of 25% tariffs, Gold fell below $1,330. Gold was supposed to be...

Despite the uncertainty created by the US and China with the exchange of 25% tariffs, Gold fell below $1,330. Gold was supposed to be bullish due to safe-haven demand, but what made it fall so badly? Let me help you figure it out…

Gold – XAU/USD – Fundamentals Review

Recalling our April 4 – Economic Events Brief, we discussed the importance of US ADP and its potential impact on the market. The Automatic Data Processing, Inc. reported an employment change of 241K vs. 208K forecast which gave support to the US dollar during the New York session.

If you remember, the ADP figure is mostly correlated with the Non-Farm Payroll figure and is often called the advance NFP. This is because the ADP figure is released before US labor market data and the NFP typically comes out in a similar direction.

For now, the market is expecting NFP to beat the forecast making the US dollar stronger on sentiments, which is why Gold is coming to its knees.

Gold – 120 Min Chart

Support Resistance

1331.5 1334.7

1330.5 1335.7

1328.9 1337.3

Key Trading Level: 1333.1

Gold – XAU/USD- Trading Idea

Gold is likely to gain support near $1,324/22 and that’s where I’m looking to take a quick buy for 40/50 pips. Stay tuned!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account