Markets on Wednesday: China Eases Fears & Markets Rally

As has been the case in recent times, it was more news headlines that got the markets moving on Tuesday.

As has been the case in recent times, it was more news headlines that got the markets moving on Tuesday. Fortunately for investors, it was good news for a chance.

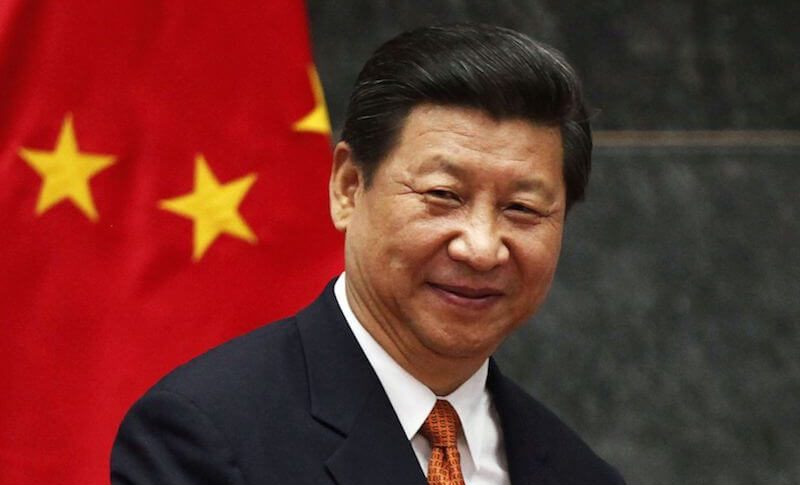

Chinese President Xi, speaking at a keynote address, looked to tone down the trade war fears. He spoke about free trade and removing restrictions in China. That was exactly what the market wanted to hear and US stocks skyrocketed.

The USD weakened a touch throughout the day, however, commodities rallied hard. With Oil the big performer up nearly 4%. While gold was also strong.

The commodity currencies were also strong against the USD, with the AUD, NZD and CAD all performing well.

Bitcoin was traded water a little. After failing at resistance at 7,000 things remain perilous for the digital currency. A break of the lows is near and that could spell trouble.

Overall Weakness

The USD fell on Tuesday and is now back towards the bottom of the range between 89.50-90.50.

I will expect a potential bounce off these levels, despite the fact that the trade wars might now be easing off.

We still have some big data this week that may now take more of an important role. With US CPI and the FOMC minutes the main focus. Interestingly, PPI produced a strong result and we saw a weak dollar, so I think CPI will end up being a market mover.

US Dollar Index (DXY)- 240 min Chart.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account