WTI Crude Oil Breakout of Sideways Range – EIA Inventories Slip!

the EIA reported a draw of -1.1M versus the forecast of -0.5M barrels. The crude oil price soared to a 3-year high. Moreover, investors...

On Wednesday, the EIA reported a draw of -1.1M versus the forecast of -0.5M barrels. The crude oil price soared to a 3-year high. Moreover, investors are also trading the rumours that Saudi Arabia is thinking of raising the oil price. Is it likely to continue its bullish momentum? Let’s find out…

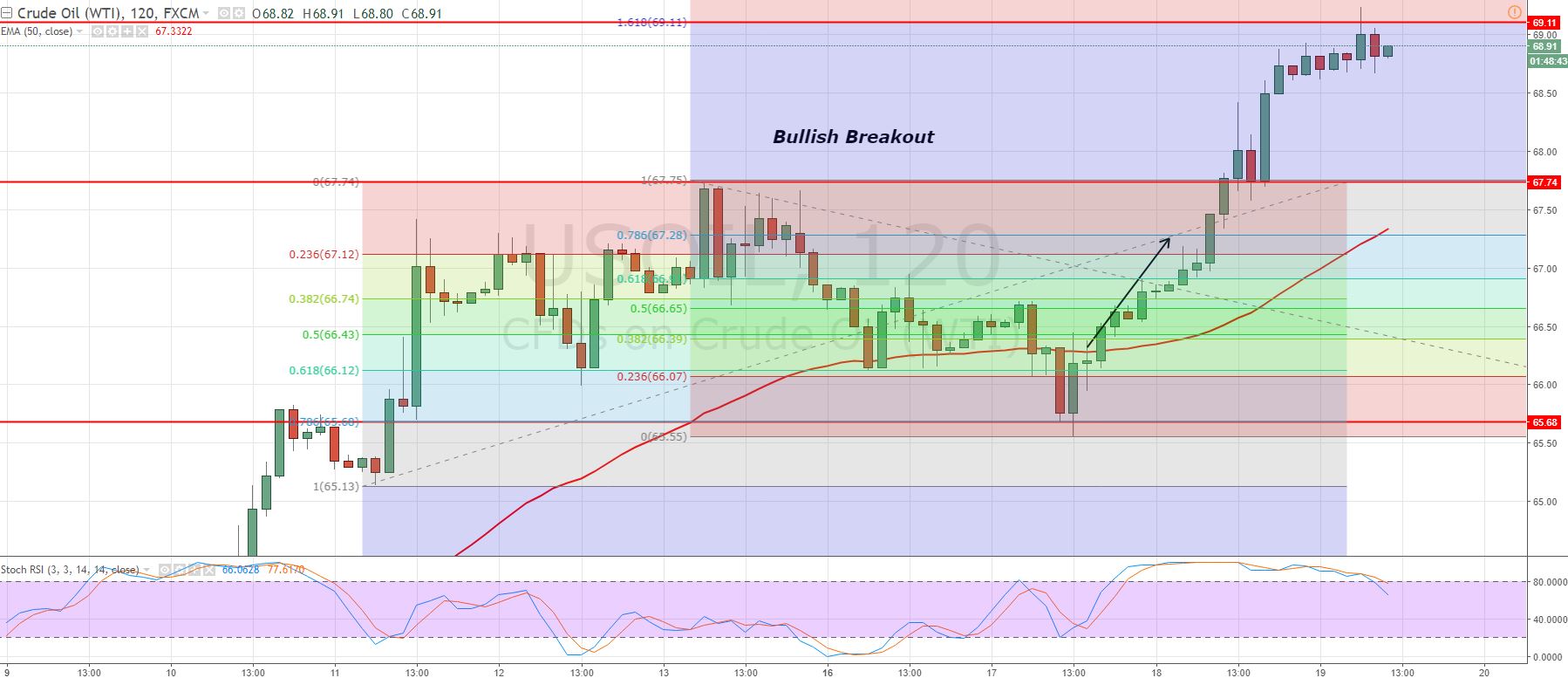

WTI Crude Oil – Sideways Channel Breakout

Fellows, oil consolidated in a narrow trading range of $65.65 – $67.75 throughout the week but managed to break out of the range on the release of API and EIA reports as both of these showed a draw in inventories. It seems like traders have purchased large quantities of crude oil in response to fears spread by airstrikes on Syria by the United States.

WTI Crude Oil – 120 Mins Chart

Crude oil has completed a 161% extension and it can face a solid hurdle at $69.15. A break above this level is likely to open further room for buying until $70, while we can also expect a retracement of the overbought crude oil price below $69.15.

WTI Crude Oil – Trading Plan

For now, I’m looking to stay bearish below $69.15 for a quick 40 pips. However, buying will be preferred on a breach of 69.15, to target $69.75. I will be looking to stay bearish below $66 to target $65.15 today. Stay tuned!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account