Fakeout in EUR/JPY While PMI Numbers Disappoint

During the European open we shared a forex trading signal in EUR/JPY which remained in profit for a while but after an unexpected reverse in the market, we lost. The euro weakened due to a mixture of disappointing economic releases. Does this mean more room for disappointment, though?

EUR/JPY Spiked Up, Fakes Out & Reverse Back – What’s Happened Exactly?

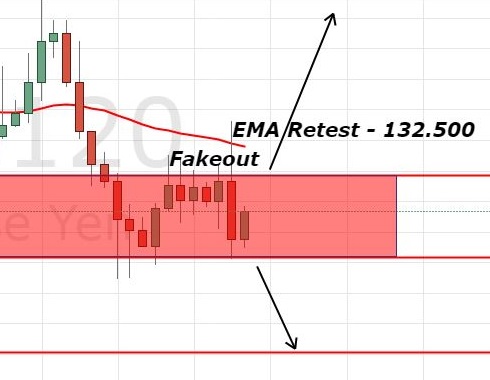

Just a couple of hours ago, the Eurozone released a number of medium impact PMI (Purchasing Managers’ Index) figures. The German and French PMI upbeat past data with flying numbers, causing a spike in EUR/JPY. The cross pair broke out of the 132.400 resistance zone and was supposed to face the next resistance at 132.850.

Unfortunately, the bullish spike was short lived as the market reversed afterward upon the release of Flash Manufacturing PMI. The figure slipped to 56 from a forecasted 56.6.

EUR/JPY – Sideways Channel

At the moment, the EUR/JPY is trading sideways in a narrow trading range of 132.150 – 132.400. The violation of the lower boundary could lead the pair towards 131.700 and 131.350. Whereas, a bullish breakout could drive more buyers to 132.850.

EUR/JPY – 120 Min Chart

EUR/JPY – Trading Plan

It will be nice to trade the breakout on either side. The idea is to place a sell stop below 132 and a buy stop up at 132.500 to target a quick 30/40 pips today. Good luck!