Crude Oil Standstill as Trump lashes on OPEC – EIA Report In Limelight

What’s up, fellas.

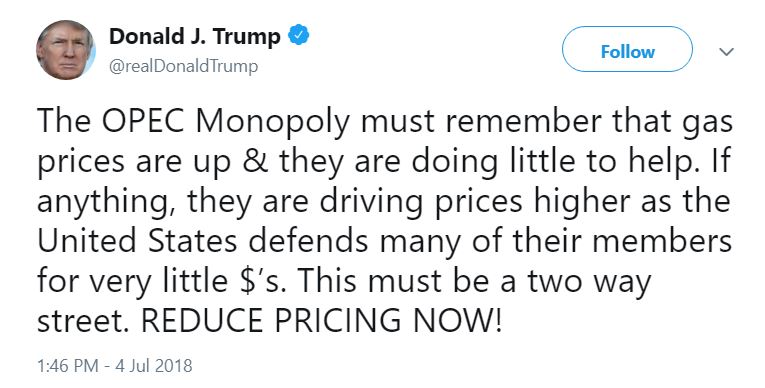

The global financial markets remained bit muted on Wednesday in the wake of U.S. holidays. But the POTUS Trump just couldn’t resist using twitter as lashes on OPEC and advice to lower the oil prices.

Here’s what he tweeted:

Recalling the U.S. Tax reforms, Trump supported their economy, especially the business and labor sector by cutting the tax rates. But over the period of time, the oil price has rebound from $25 to cross above $70. Looks like a surge in the oil prices could undo some of the effects of the administration’s tax reform.

API Stockpiles Report

On Tuesday, the American Petroleum Institute (API) reported a draw of 4.5 million barrels for the week ending on June 29. This shows a massive increase in the demand for crude oil during the previous week. Looks like the investors increased their bets after Trump urged European allies to stop buying Iranian oil.

EIA Inventories Report

The EIA (Energy Information Administration) report is coming out at 15:00 (GMT). As per economists’ forecast, the data is expected to show a draw of -4.4M vs. -9.9M previously. As you know, there’s a positive correlation between the API and EIA reports, the -4.4M seems to be already factored in.

Besides this, I would like your to check FX Leaders July 5 – Economic Event’s Report as we also got to deal with advance NFP and FOMC meeting minutes today. I’m saying this because the dollar has a strong negative correlation with oil and any change in the dollar will guide us the next path.

WTI Crude Oil – Trade Plan

Fellas, crude oil trading signal mainly depends upon the EIA stockpile report. However, I will be keeping a close eye on $72.65 as the markets can stay bearish below it until $71.65. Whereas, the bullish breakout can lead oil to $73.65 today. Good luck.