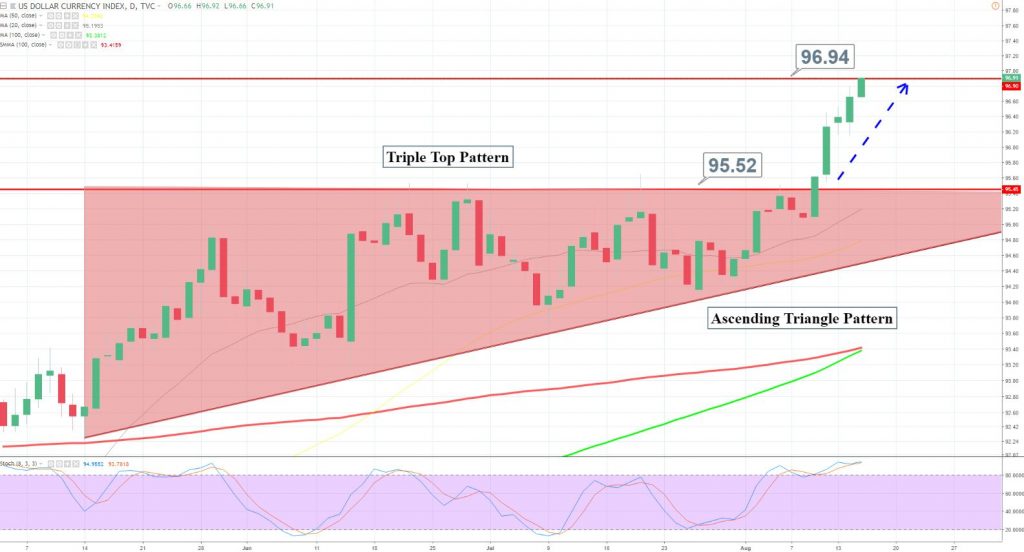

Dollar Index jumps to 13 months high – Safe haven demand peaks!

The dollar jumped to its highest levels in over a year as a crisis in the Turkish lira that has spread and the investors seem to move ...

The dollar jumped to its highest levels in over a year as a crisis in the Turkish Lira has spread and the investors seem to move their funds into the safe haven currency Greenback.

The reason why investors are moving their investments in the dollar is mainly due to the signs of robust economic growth in the U.S. economy. The expectations of two additional rate hikes are keeping gold on its toes while keeping the dollar on fire.

Dollar Index – Daily Chart

This morning we spoke about a potential target for the U.S. dollar and the market is about it hit it at $97.25. On the way, the dollar index may face another resistance at $96.95.

Investors are advised to see the U.S. economic events like core retail sales which are due to come out in 45 mins now. These may help us determine the next trend in the dollar. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account