Sideways Channel In Gold – Can US Economic Events Cause a Breakout?

On Tuesday, gold inched down as the dollar hit a one-week high on the back of escalating global trade anxieties and economic upsets in...

On Tuesday, gold inched down as the dollar hit a one-week high on the back of escalating global trade anxieties and economic upsets in emerging markets. The reason behind bearish gold is the same.

A stronger US dollar makes gold more costly for holders of other currencies. Which is another reason why the safe haven asset isn’t getting a boost in demand.

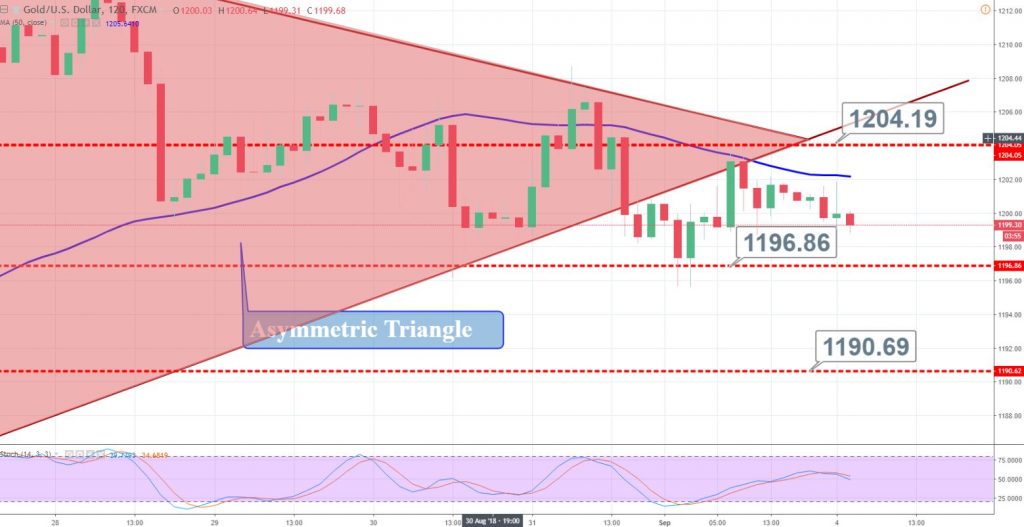

On the other hand, gold is stuck in a tight range of $1,197 – $1,204. Investors do need a solid reason to violate this trading range. What can it be? Did you see FX Leaders Sep 4 – Economic Event Outlook?

We spoke about ISM manufacturing PMI which is coming out during the New York session. So let’s wait for it. A bearish breakout can lead gold towards $1,190. Whereas, the violation of $1,204 can lead it towards $1,209 and $1,212. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account