Crude Oil Standstill Before EIA Report – What to expect?

crude oil is facing a solid resistance near $72.50. The 20 and 50 periods EMA is supporting the commodity near $72. The violation of $72.50

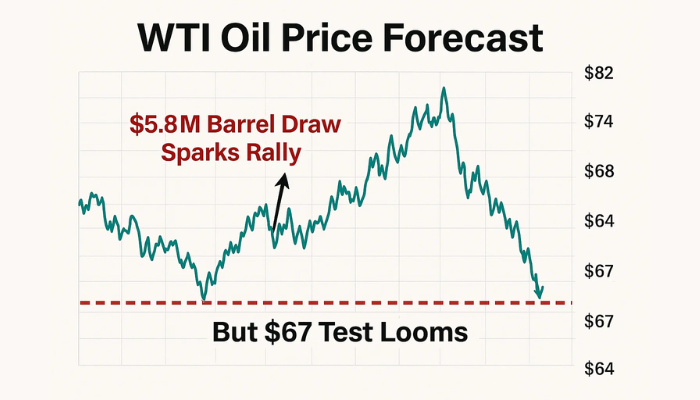

Crude oil continues to trade bullish as traders remained wary over the supply outlook, although the fallout from global trade tensions between the U.S. and China limited price gains. Before we proceed towards today’s technical outlook, let us recall that the WTI price has been under a selling pressure as trade tensions between the United States and China have heated up. However, the imminent sanctions on Iran have already begun to diminish flows of crude oil.

Looking at the technical side, crude oil is facing a solid resistance near $72.50. The 20 and 50 periods EMA is supporting the commodity near $72. The violation of $72.50 can lead oil prices towards $73.35. Whereas, the market can remain bearish below $72.15. Looking at the strength of the recent bullish candle, it looks like crude oil will manage to violate $72.50 to target $73.35 and $73.65.

Support Resistance

71.59 72.43

71.3 72.96

70.46 73.8

Key Trading Level: 72.13

WTI Crude Oil – Trade Plan

The idea is to stay bullish above$72.20 with a stop below $71.90 to target $72.55 and $73.25. For now, let’s wait for the EIA (Energy Information Administration) crude Oil inventories for the previous week which are due to be released at 14:30 GMT. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account