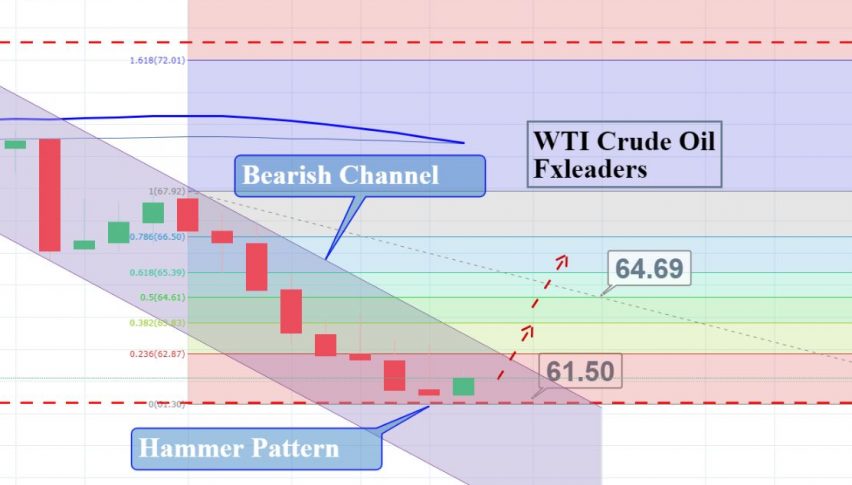

Bullish Reversal Pattern In WTI Crude Oil – Brace Yourself for 200 Pips!

On the daily timeframe, crude oil has formed a hammer pattern near $62. This pattern is followed by a strong bearish trend and it's known...

•

Last updated: Thursday, November 8, 2018

Almost all the trading instruments are moving sideways, which reveals the state of indecision among traders. That’s mostly because of the FOMC and Fed fund rate which are due during the US session. Anyhow, we just opened a swing trade in crude oil to go long above $62.20 to target $64. Here’s why going long looks like a good idea…

- Chinese crude imports raised concerns that a slowdown in the world’s No.2 economy could fuel an emerging fuel glut. According to the recent news, China’s October crude imports climbed 32% from a year earlier to 40.80 million tonnes, or 9.61 million barrels per day (bpd). We assumed that the trade war may diminish crude oil’s consumption in China, but the scenario is the opposite now.

- On the daily timeframe, WTI crude oil has formed a hammer pattern near $62. This pattern is followed by a strong bearish trend and it’s known for breaking the trend. So, can it reverse the crude oil’s bearish trend? Well, I hope it will as it’s one of the major reasons we entered a buying position. Good luck and stay tuned for more updates!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.