Crude Oil’s Bearish Momentum Continues – Investors Fear Oversupply

The Organization of the Petroleum Exporting Countries (OPEC) and other oil producers including Russia decided this month to curb output by..

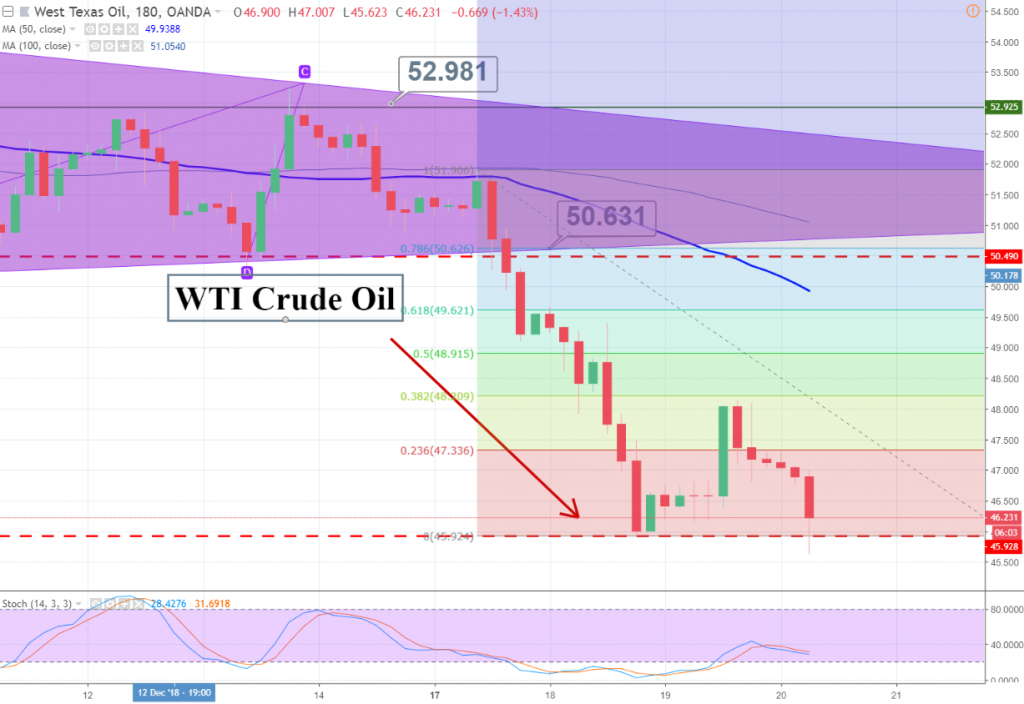

Fellas, the WTI crude oil prices continue to trade with a bearish momentum, heading back towards $45.75, the lowest levels in more than a year. Most of the bearish bias has been triggered over investors’ worries about oversupply, and the outlook for energy demand remains vulnerable.

Organization of the Petroleum Exporting Countries (OPEC) and other oil producers including Russia decided this month to curb output by 1.2 million barrels per day (bpd) in an effort to reduce containers and boost prices. But the strategy doesn’t seem to work.

Anyhow, the technical side of crude oil is also exhibiting a strong bearish trend. For instance, the WTI has slipped below an intraday support area of $47.50 and next support is likely to be $45.95.

Here’s the thing – crude oil can stay bullish above $45.95 while the bearish breakout of this level can cause further sell-off until $44.50.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account