Gold Steady at Peak – FOMC’s Dovish Sentiments in Play

On Wednesday, the precious metal GOLD trades near eight-month highs on concerns over US-China trade war. Moreover, the FOMC sentiment remains dovish as the interest rates will likely be kept unchanged by the Federal Reserve.

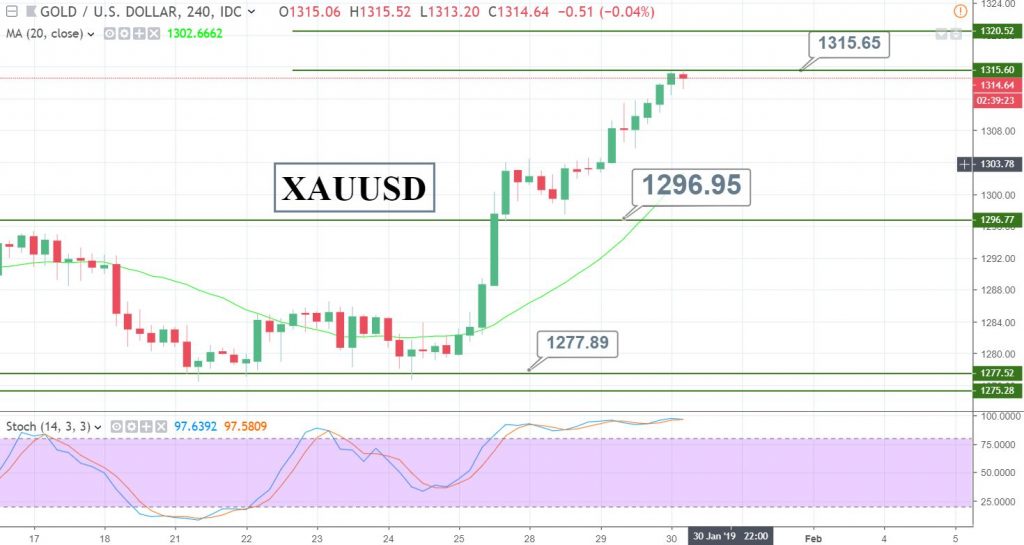

Gold continues to trade bullish in a range of $1309 – $1320. It looks like the traders are pricing in the dovish sentiments from the Federal Reserve.

FED Monetary Policy – The Sentiment Analysis

Fx junkies are expecting a dovish monetary policy this month. The Fed is widely expected to keep the interest rates on hold at 2.50%.

In recent speeches, the Fed Chair Powell repeated that view, but at the same time made it clear that if the Fed ever came to a different conclusion, it would not hesitate to change the pace of balance-sheet reductions.

The FOMC Statement is also expected to go mute unless it surprises the market with something new, which is very less likely.

Therefore, we can expect investors to continue trading the market with a weaker dollar sentiment. While the weaker dollar ultimately underpins the demand for safe-haven asset gold.

What’s the Trade Plan?

Despite that, I don’t mean we need to jump in gold right away. It’s better to wait for the actual decision and we also need a slight correction in gold before placing bullish bets.

Support Resistance

1305.73 1314.9

1299.76 1318.1

1290.59 1327.27

Key Trading Level: 1308.93

Looking at the chart (H4), both of the momentum indicators, the RSI and Stochastic, are holding above 80 & 70 sequentially. It signifies that gold is overbought and it may drop a bit to complete 23.6% Fibonacci retracement at $1,310 and 38.2% retracement at $1307. I will be looking to stay bullish above $1,309 today.

Let’s wait for the ADP and FOMC releases today.