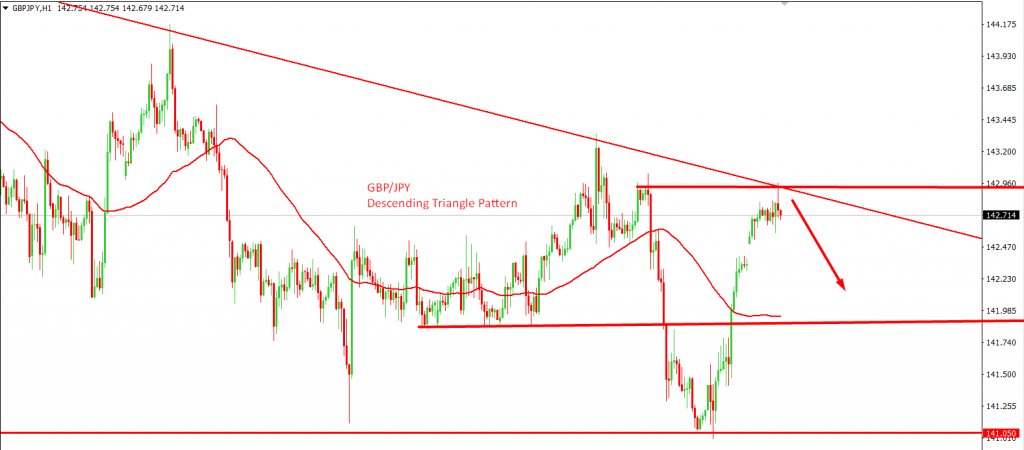

GBP/JPY – Pound to Japanese Yen Trades Descending Triangle, What’s Next?

GBP/JPY is trading bullish near 142.850 as the pair is facing a hard time violating this level. Find out what to expect next...

What’s up, fellas.

As expected, the market is muted, trading sideways, but it’s a perfect opportunity to trade short term signals. The short-term technical outlook for the Pound to Japanese Yen seems bearish.

On the fundamentals front, the BOJ former Deputy Governor Iwata wants Japan to cancel the sales tax hike. It’s pointing towards the fiscal stimulus which causes an increase in the supply of Japanese Yen in the market.

Support Resistance

141.46 142.87

140.53 143.35

139.12 144.76

Key Trading Level: 141.94

As a result, GBP/JPY is trading bullish near 142.850 as the pair is facing a hard time violating this level. Actually, it’s a bearish trendline which is keeping the Japanese cross in a bearish mode. On the lower side, investors need to keep an eye on 141.050 support.

Just in case there’s a bullish breakout at 142.800, the pair can go after 143.45.

Let’s wait and watch how the market reacts to the US open.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account