The Case for and Against a Rate Cut for the AUD/USD

The word out of the RBA this past week has been a clear one. They stand ready to act should economic conditions warrant a change.

There has been no official change to monetary policy in Australia for more than two years and given the change of stance that we’ve seen recently from the RBNZ, the ECB, RBC, BOE, BOJ and of course the FOMC, it only stands to reason that the RBA will be next.

While it did change it’s outlook to more of a neutral stance, suggesting there is room to cut, the minutes this week revealed the key ingredients it would need to see a cut in rates. And this was a significant change from the word that has been coming from the RBA in many years, which has always been bordering on hawkish.

The key metrics that the RBA are now watching are jobs and inflation. So these are the two numbers that we would see to see fall away for a cut to be on the table.

This week, we also saw official jobs increase above expectations. As I mentioned through the week, the RBA is looking for a ‘trend’. So the first data point is clearly not a dovish one, with nearly 28K new jobs created last month and the unemployment rate holding steady. That said the prior month disappointed, but we have seen the unemployment rate tick lower, which might be a more powerful number for the RBA to assess. The current rate is 4.9%.

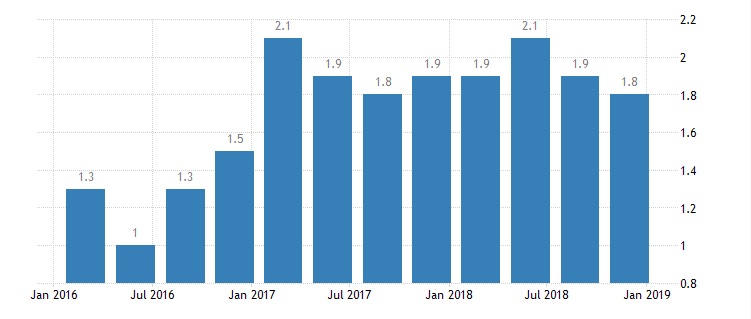

The current inflation rate, on the other hand, is still struggling to make any progress towards the RBA’s target band of 2-3%. I is currently around the 1.8% mark. The RBA is expecting this to fall to 1.75% before rebounding to 2.0%.

As we saw this week in New Zealand, lacklustre inflation is a real concern and will likely be the trigger for a rate cut.

The RBA also suggested the case for a near-term hike is very slim at the moment. So the question to ask is really just if and or when the RBA might cut?

My personal opinion is that they will do everything in their power to avoid cutting rates. Unless the numbers turn really bad, really fast they will hold onto the current rate of 1.5% until the bitter end.

Despite that, futures markets are continuing to price in a rate cut in October, with a decent chance in August as well. So I might be the odd one out at the moment.

Bottom Line: Keep a close eye on inflation and employment in the coming months as these are the keys to the RBA cutting rates.