Butterfly Drives Buying In Crude Oil – Brace to Capture

WTI crude oil is modestly higher crossing over 55.50, gaining back all the losses made in the wake of a trade war and delay in OPEC's...

On Thursday, WTI crude oil is modestly higher crossing over 55.50, gaining back all the losses made in the wake of a trade war and delay in OPEC’s meeting. Another reason behind WTI’s bullishness is the dovish FOMC.

What does a dovish FOMC have to do with crude oil prices?

US dollar and Crude Oil prices carry a negative correlation. Thus, the dovish FOMC triggered a sell-off in the dollar, making it cheaper for international buyers. Increased inflow of interest triggered sharp buying in crude oil.

Secondly, the OPEC and OPEC+ finally agreed on dates to have a meeting. They are likely to speak about continue crude oil output cut for a more extended period to control falling oui price.

Thirdly, the Energy Information Administration announced Wednesday that US crude stocks declined by 3.1 million barrels supporting the bullish bias of traders.

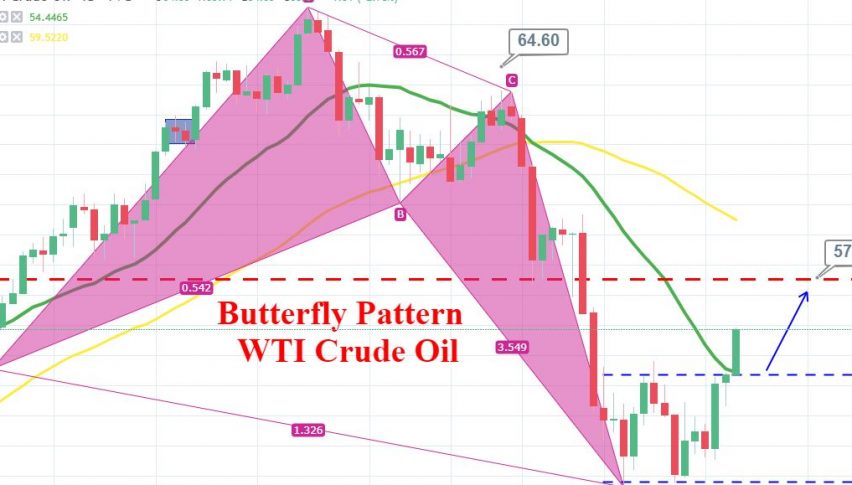

Crude oil has formed a bullish butterfly pattern on the daily timeframe, which is suggesting a strong tendency for an upward move. The butterfly pattern completed CD move from $64 to $50 and now it’s likely to trigger bullish retracement. Crude oil may have immediate support at $54.40, along with resistance at $56.60 and $57.55.

WTI Crude Oil – Trading Signal

We have already open forex trading signal in crude oil with an idea to stay bullish over 55.728 with a stop loss at 55.328 and take profit of 56.028.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account