Forex Signals Brief for June 24: Trump, Xi and the G20 Looms

Markets will be waiting patiently this week as US President Trump and Chinese President Xi meet at the G20 to discuss the ongoing trade sagas between the two countries.

Last week, President Trump indicated the two leaders would have extended discussions in a bid to get back on the same page. Previously negotiations had broken down during May and since that point haven’t really been back on track. This week is a chance for the two parties to get negotiations moving forward but things are still a long way from any kind of trade deal.

There will also be a number of Fed speakers doing the rounds this week. We are all on the edge of our seats as to if and when the FOMC will cut rates after Fed boss Jerome Powell made a strong case for the doves. The speakers will potentially release some more information as to what a timeline might look like.

Overall the data is a bit thinner over the course of the week, with US GDP and Eurozone CPI being the standout events. Today German business climate is the main top-tier event and that will impact the EUR/USD.

Forex Signal Update

The FX Leaders Team finished with 12 wins from 20 signals, for a strike rate of 60%.

USD/JPY – Active Signal

The USD/JPY has broken down through the 108 level and is looking weak. Clearly, a big dive in the Greenback has led the downward spiral after the FOMC came out with some dovish guidance. We are short and looking to go with the trend.

USD/CAD – Active Signal

The USD/CAD, has been in the same boat as the Yen with a weak USD being the main driver. At the same time weak prices in WTI are likely to be a factor at the moment as well. We are short and looking for the 1.3200 level to hold as resistance.

Cryptocurrency Update

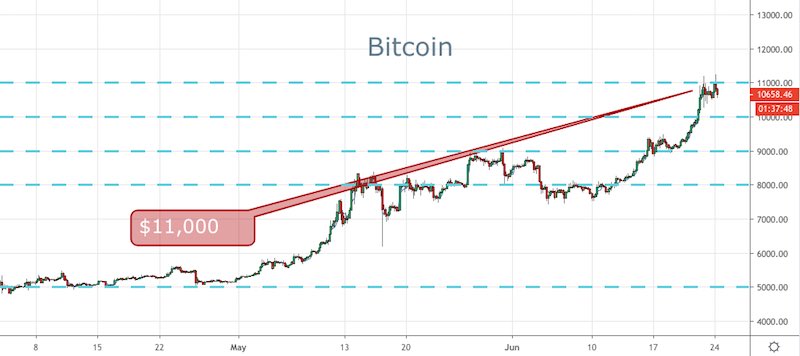

BTC has had a huge weekend to say the least. Last week we were predicting a move to $10,000, but we have seen price spike straight through and test $11,000.

Facebook’s Libra was clearly the catalyst, but there is plenty of interest around at the moment and taking out the psychologically important $10,000 level is going to drive even more interest early in the week in the mainstream media.

I am fully expecting the entire sector to remain strong, but much depends on how price reacts around the $10,000 mark.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account