Forex Signals Brief for June 26: Are the Doves Getting Nervous?

Just when we thought interest rate cuts in the US were a done deal, a couple of Fed speakers have cast a little bit of doubt back into the m

Just when we thought interest rate cuts in the US were a done deal, a couple of Fed speakers have cast a little bit of doubt back into the market.

Both the Fed boss Jerome Powell and member Bullard were speaking yesterday, with the latter in particular pouring a bit of cold water on the idea that there might be 50bp of rate cuts in the works.

The market has been looking at July as the time the FOMC might well cut rates, but that now might be a bit less likely than it was this time yesterday. As a result, equities were weak with the SPX falling, along with GOLD, while the US Dollar managed to bounce for the first time in quite a few sessions. Today we will be watching to see if there is some further follow through that will likely test the nerves of the doves.

Data is a little thin once again today, with BOE Governor Carney speaking which might nudge the GBP/USD. While in the US we only get Core Durable Orders. WTI remains on close watch ahead of inventory data.

Forex Signal Update

The FX Leaders Team finished are having a huge week to date with 10 straight winners. Now would be the perfect time to take a closer look at our forex signals page.

USD/JPY – Pending Signal

The USD/JPY has had a bit of a bounce, which really just coincides with the move in the Greenback. Given the strong downtrend though, this would be a good time to hunt a short trade as we can ride that longer time frame momentum for the time being.

Oil – Pending Signal

WTI has bounced of recent times, which is a bit of a change in trend. We saw a big draw in the API inventories and Crude will be on watch today ahead of the official release.

Cryptocurrency Update

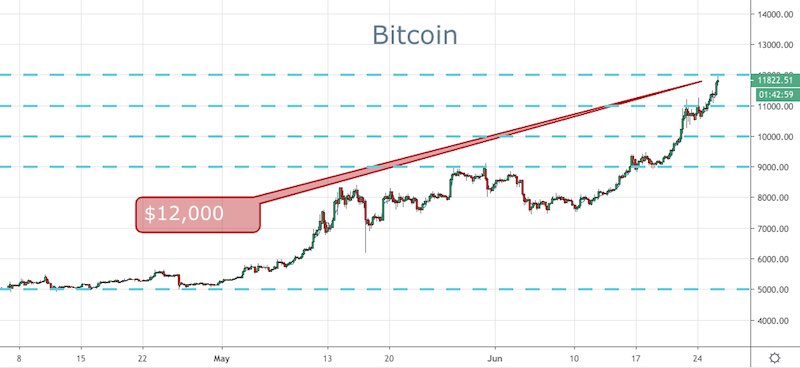

BTC just keeps powering along as there is really no stopping the momentum at the moment as it hones in on the $12,000 mark. We’ve seen price tag that point in Asian trade, so we are now on close watch.

As I mentioned yesterday, the $11,500-$12,000 region which is the backside of the big run from 2017, is the major resistance level. Price has broken through that bottom end of the range so far in Asian trade and looks to be set for a test of the upper end.

There was news that payment processor Square will be adding Bitcoin, which is another big endorsement as it is a significant player in that space these days.

The momentum remains strong for the time being so keep riding it for now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account