Bears Dominate Crude Oil – Trade War Tensions Escalate

On Monday, crude oil traders continue to dominate the oil market after the United States President Donald Trump imposed additional tariffs on Chinese imported goods, escalating the trade tensions between the world’s two largest economies and WTI crude oil consumers.

Donald Trump’s tweet created shockwaves in international stock markets, whereas WTI crude oil prices fell about 7% due to the story. It was their biggest plunge in more than 4-years. WTI crude oil prices were already down by more than 3% before Donald Trump’s statement.

Crude oil continues to experience significant headwinds amid risk appetite remaining fragile in the wake of weaker global growth and an unexpected escalation in the Sino-US trade conflict.

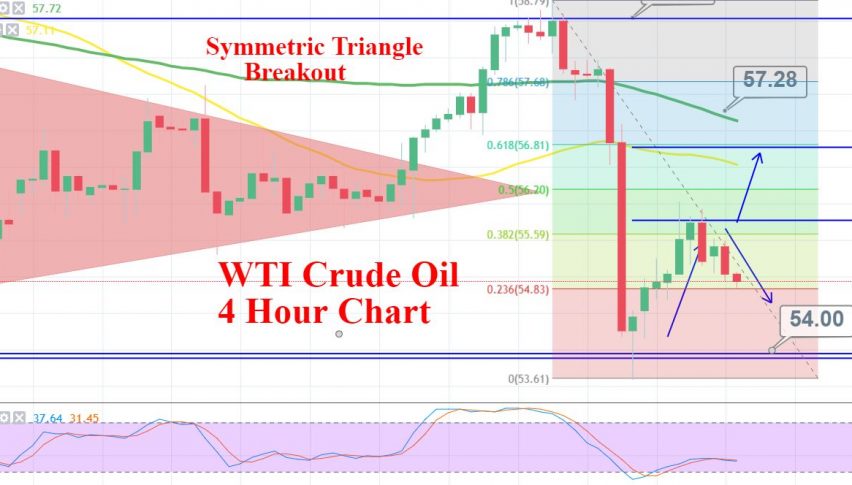

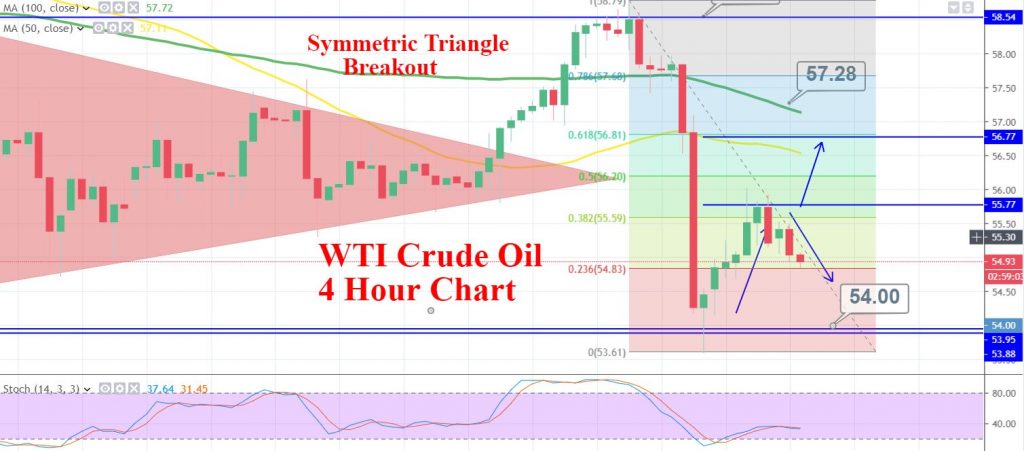

WTI Crude Oil – Technical Outlook

On the technical side, crude oil is slightly bullish at $55.07 and it may head towards the $55.60 resistance area which marks the 38.2% Fibonacci retracement level. Below this, we may see oil falling towards $54.85 support. While, the bullish breakout of this level could extend buying until $56.77, the 61.8% Fibo level.

Support Resistance

54.59 55.94

53.98 56.68

52.63 58.02

Key Trading Level: 55.33

WTI Crude Oil – Trade Idea

The idea today is to stay bearish below 55.45 with a stop loss over 55.95 and take profit around 54.70 and 54.

Good luck!