Weekly Outlook, Sep 2-6: Five Days, Five Events, Brace for Impact

Three G10 central bank meetings in the first week of September: Australia (September 3), Canada (September 4), and Sweden (September 5)....

Howdy, traders.

I hope you are having a great weekend. The long summer holidays are about to end and the volatility will be back from Monday. So, it’s going to be a fun week to trade, especially due to the most-awaited Non-farm payroll figures which are due on Friday.

Overall, the US dollar index was flat on Friday, with the Chinese yuan directed toward its biggest monthly drop in 25 years as the two countries served for the implementation of new retaliatory tariffs on Sunday. The dollar index was 0.02% lower at 98.483, concluding the month mostly unchanged after having been thrashed around by trade headlines.

On Monday, we may experience a safe haven appeal kicking in the market as an additional 5% tariff on $125 billion of goods from China is expected to kick in on Sunday. With this, traders fear that the intensifying trade conflict could drive the US economy into recession.

The upcoming week is fully loaded with high impact economic events, with US nonfarm payroll data at the top of the list.

There are three G10 central bank meetings in the first week of September: Australia (September 3), Canada (September 4), and Sweden (September 5). None are anticipated to cut rates, but all three are anticipated to provide the basis for a rate cut at the next meetings.

Watchlist – Five Days, Five Events, Brace for Impact

Caixin Manufacturing PMI – Monday, 01:45 GMT

On Monday, Markit is due to release the manufacturing PMI figures for China. It’s a leading indicator of economic health – businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company’s view of the economy.

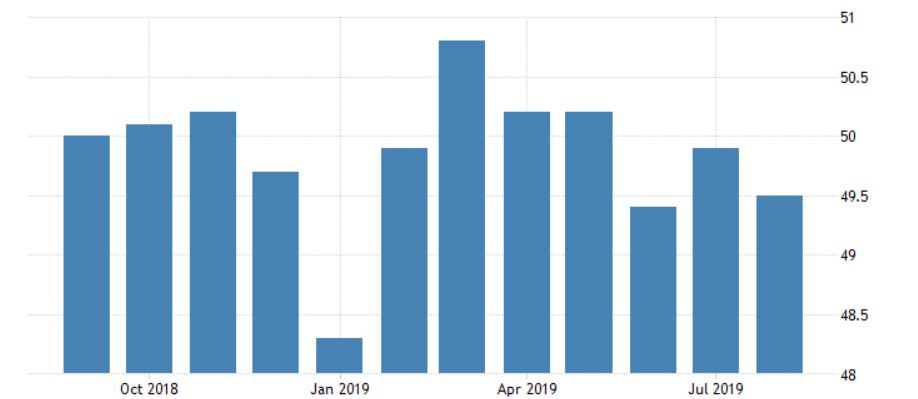

Manufacturing PMI in China decreased to 49.50 in August from 49.90 in July of 2019 as reported by Markit Economics. Whereas, another drop to 49.8 is on the cards.

Before we move to the next important event, let us recall, the PMI figures are compared against the 50 thresholds. Where, above 50.0 indicates industry expansion and below indicates contraction.

RBA Cash Rate & Statement – Tuesday, 04:30 GMT

On Tuesday, all eyes will be on the monetary policy decision from the Reserve Bank of Australia. So far, the RBA has cuts rates in May and June. Since the end of April, the currency has dropped around 4.8%. The sequence of some fiscal stimulus (tax cuts and spending rises) paired with the lower rates. The weaker Aussie ought to help the economy find some support, but it has not yet done this.

Overall, traders are not expecting a rate cut from RBA as the market data still has slacks and the US-China trade war is still keeping Australia’s economy uncertain. Therefore, I’m expecting the Reserve Bank of Australia to keep the rates unchanged at 1.00%.

Bank of Canada Overnight Rate & Statement – Wednesday, 14:00 GMT

With just one week to go until the Bank of Canada’s interest rate decision, National Bank of Canada has arisen as an outlier to keep the overnight rates unchanged from October 2018.

However, there’s plenty of sentiments expecting that the central bank will cut rates this fall amid mounting global trade tensions.

BOC’s current rate is 1.75% while economists are expecting it to be same this month.

Any surprise change in rate is going to drive aggressive price action in the Loonie for at least 100 to 200 pips. So better be ready for any surprise.

ADP Non-Farm Employment Change – Thursday, 12:15 GMT

For all the newcomers, the ADP (Automatic Data Processing) is also known as an advance NFP. It shows an estimated change in the number of employed people during the previous month, excluding the farming industry and government. The Automatic Data Processing, Inc. releases the figure in the first week of a new month, particularly on Wednesday.

Typically, the ADP figures signal about the Nonfarm payroll figures, whether it’s going to be positive or negative. Which is why both of the data shares a positive correlation.

Anyways, the ADP nonfarm employment change is due at 12:15 (GMT).

Back in July, the private sector report from ADP beat expectation of 150K jobs while releasinga reading of 156K jobs, setting higher standards for the upcoming NFP figures. However, August’s report may be somewhat more moderate as economists are expecting an increase of 150K which is not as strong as of July’s figure. The greenback can stay under bearish pressure today.

Labor Market Report – Friday, 12:30 GMT

At 12:30 GMT on Friday, the Bureau of Labor Statistics will be releasing the nonfarm employment change. Although only 164K jobs were added last month, this month’s figure is expected to rise to 168K.

The unemployment rate is expected to remain unchanged at 3.7 vs. 3.7%. Folks, there’s a moderate positive correlation between ADP employment change and NFP employment change figures. That means, the positive ADP figures leads to positive NFP sentiment.

Average Hourly Earnings m/m – Traders, despite the importance of NFP, we can’t overlook the average hourly earnings which are also releasing at 12:30 GMT.

How is it going to help us?

In case of muted nonfarm data, investors usually turn their attention to average hourly earnings reports. For your information, the earnings are expected to release 0.3% figure which is not different from the previous 0.3% jump in average hourly earnings.

That’s it for this week, but do check FX Leaders economic calendar for the live coverage of these major events.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account