Daily Brief, Sep 3: Economic Events Outlook – Brace for RBA Cash Rate

Fundamentally, the economic calendar is a bit busy amid RBA Cash Rate and Statement. The U.S. ISM Manufacturing PMI will also be in..

Good morning, traders.

The greenback was at its highest in more than two years against a basket of six other currencies, while global stocks were hammered by US-China trade disputes. China has registered a complaint against the US at the WTO (World Trade Organization) for the massive import duties from the United States.

Despite this, the market experienced strong buying in the US dollar causing a drop in gold prices. During the US session, the precious metal gold prices fell from 1527 to 1524 as the dollar gained.

On the other hand, gold is still staying at multi-years high amid fears of a global economic slowdown fueled by intensifying US-China trade war.

Watchlist – Economic Events Outlook

Fundamentally, the economic calendar is a bit busy amid RBA Cash Rate and Statement. The US ISM Manufacturing PMI will also be in highlights today. Who’s ready to trade?

AUD – RBA Cash Rate & Statement – 04:30 GMT

On Tuesday, all eyes will be on the monetary policy decision from the Reserve Bank of Australia. So far, the RBA has cuts rates in May and June. Since the end of April, the currency has dropped around 4.8%.

The sequence of some fiscal stimulus (tax cuts and spending rises) paired with the lower rates. The weaker Aussie ought to help the economy find some support, but it has not yet done this.

Overall, traders are not expecting a rate cut from RBA as the market data still has slacks and the US-China trade war is still keeping Australia’s economy uncertain. Therefore, I’m expecting the Reserve Bank of Australia to keep the rates unchanged at 1.00%.

EUR – Spanish Unemployment Change – 07:00 GMT

The Ministry of Employment will be reporting the change in the number of unemployed people during the previous month.

Spanish unemployment change is expected to show a strong improvement in July. The figure is expected to have risen by 35.8K vs. -4.3K previously.

This may keep the single currency Euro supported today.

USD – ISM Manufacturing PMI – 14:00 GMT

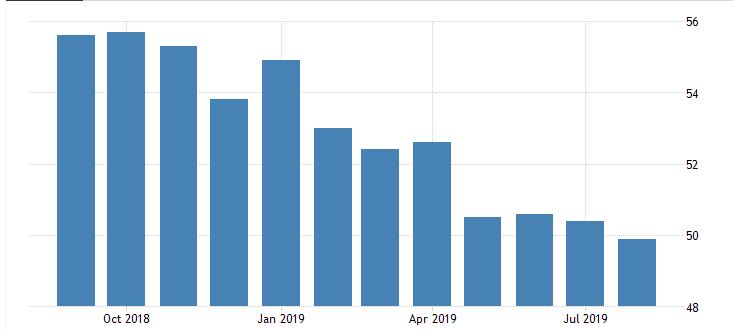

At 14:00 (GMT), the Institute for Supply Management is expected to release the manufacturing purchasing managers index. The forecast of 51.2 still represents robust growth but is weaker than 56.6, the highest in 2019.

Just like other PMI figures, ISM manufacturing is also compared against 50 thresholds. Above 50.0 indicates industry expansion, while below indicates contraction. Apart from the headline, it is important to note the higher PMI figure ultimately signals growth in GDP, sales and inflation. The latest reading pointed to the first month of contraction in the manufacturing sector since September 2009, as new orders fell the most in ten years led by the largest decline in exports since August 2009. Manufacturing PMI in the United States is reported by Markit Economics.

So, this may support the dollar in case of the positive number today.

Check FX Leaders economic calendar for the live coverage of these major events. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account