Gold Bulls Looking for Profit Taking – Check Out Buy Limit

Gold held steady near a one-week high around $1,549, supported by weak U.S. manufacturing data that elevated fears of an economic slowdown..

On Wednesday during the Asian session, the precious metal gold held steady near a one-week high around $1,549, supported by weak US manufacturing data that elevated fears of an economic slowdown and turned risk sentiment.

Moreover, the parliamentarians in the UK defeated Boris Johnson by opening the door to another Brexit delay which also added to bullish trends in gold. The dollar index also weakened amid soft manufacturing figures which produced sentiments of possible US policy easing.

In addition, the safe-haven demand remains high as the US President Donald Trump hinted that he would be “tougher” on Beijing if trade talks delayed further, increasing market fears that ongoing trade conflicts between the United States and China could trigger a US recession.

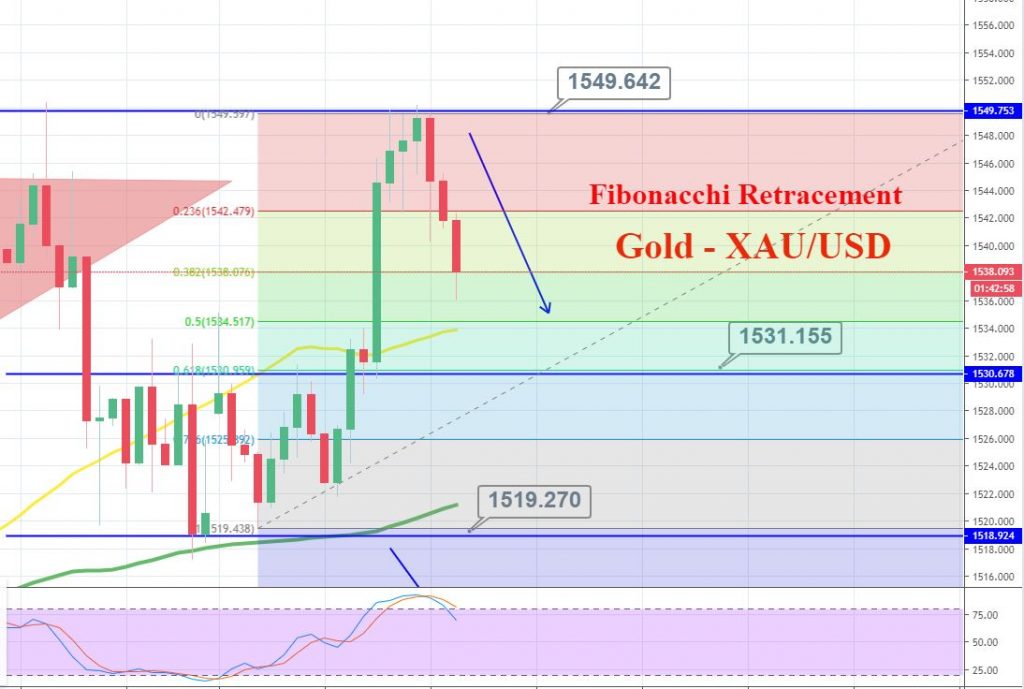

GOLD – XAU/USD – Technical Outlook

On the technical side, the oversold gold has started retracing back after placing a high of $1,549 during the Asian session.

Gold is pretty much likely to touch $1,538, the 38.2% Fibo level and $1,534, which marks a 50% Fibo retracement level.

The 50 periods EMA is likely to extend support around $1,534 and that is the level where I would like to place a buy limit today.

Gold – Technical Levels

Support Resistance

1530.44 1556.84

1513.75 1566.56

1487.35 1592.96

Pivot Point 1540.15

Fellas, consider staying bearish below $1,542 and bullish above $1,534. For now, I’m placing my buy limit at $1,534 with a stop loss around $1,532 and take profit of around $1,540.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account